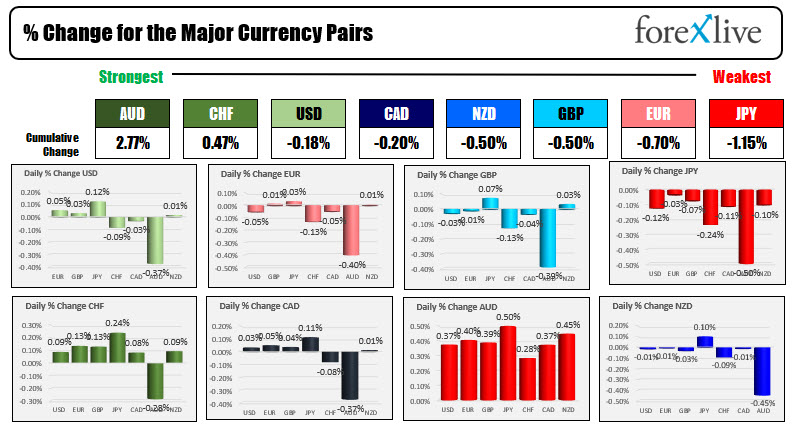

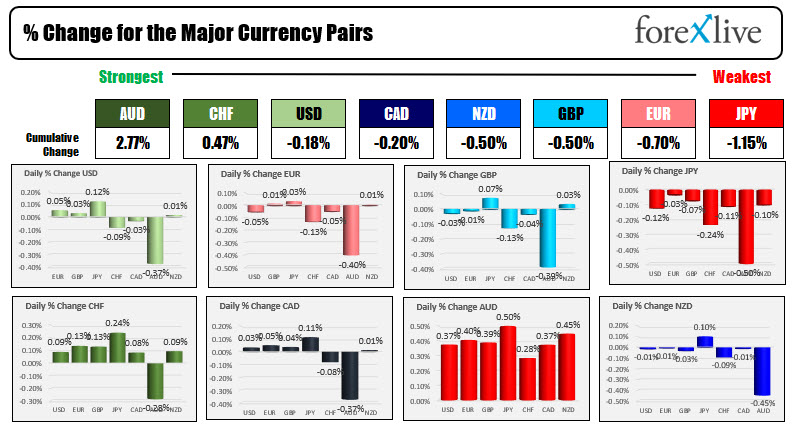

The AUD is the strongest and the JPY is the weakest as NA trader enter for the day

The USD is mixed. Slow start to the Thanksgiving week.

The AUD is the strongest and the JPY is the weakest as the NA traders enter for the holiday shortened week in the US (Thanksgiving day holiday on Thursday).

- Spot gold is down $-4.58 or -0.25% at $1840.74

- Spot silver is up $0.11 or 0.48% at $24.72

- WTI crude oil futures are trading steady at $75.84

- Bitcoin is trading lower at $57256.

In the premarket for US stocks, the futures are implying a higher opening. On Friday the NASDAQ index closed at a record level:

- Dow industrial average up 102 points

- NASDAQ index up 68 points

- S&P index is up 14.25 points

In the European equity markets are lower as Covid concerns

- German DAX is down -0.1%

- France's CAC is down -1.2%

- UK's FTSE 100 is unchanged

- Spain's Ibex is up 0.1%

- Italy's FTSE MIB is down -0.2%

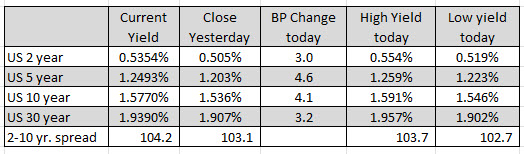

In the US debt market, the yields are trading higher with the 5 year yield near 1.25%. The cycle high reach 1.282% on Tuesday and Wednesday last week. That was the highest level since February 2020. The 30 year yield reached 2.04% last week but backed off and is trading at 1.939% currently. The high yield for the 30 year in 2021 was back in March at 2.51%. As the markets adjust toward a tightening stance the initial reaction is to take the yield curve steeper, and then flatten the curve on expectations the tightening will slow the economy. That is how that hand is being played out in the markets in the debt market.

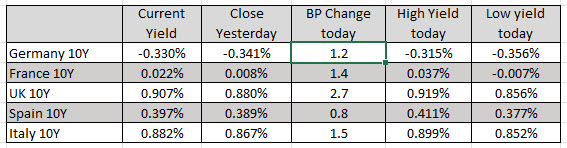

In the European debt market, the benchmark 10 year yields are trading higher as well. Europe has potential for covid slowdown more recently, and higher inflation.

November 23, 2021 at 01:08AM

https://ift.tt/3nDAmD9

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home