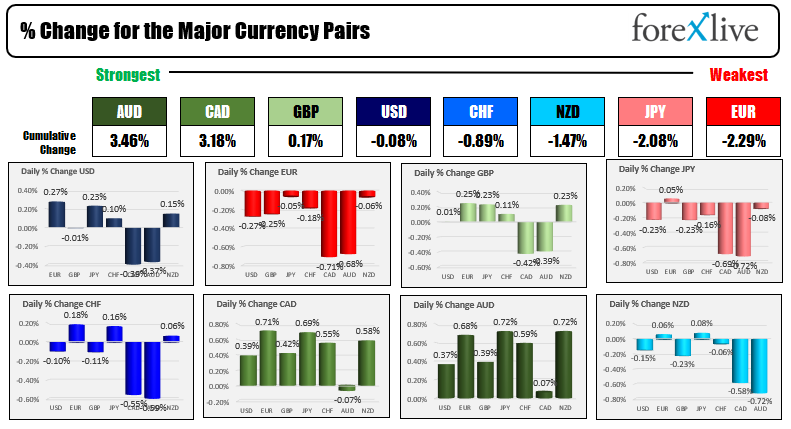

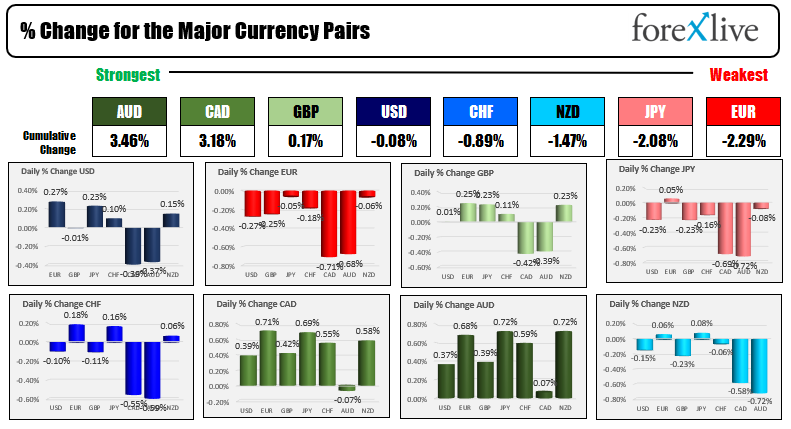

The AUD is the strongest an the JPY is the weakest as NA session begins

The USD is mixed as markets rebound from the Friday runs in respective markets

The AUD is the strongest and the JPY is the weakest as North American traders enter for the day/start of the week. The markets are recovering from the Friday runs in the respective markets. Oil prices are moving back higher after falling as low as $67.39 on Friday (trades back above $71.50). Talk that OPEC+ will stall the pattern of increased production given the new variant. The US stocks in pre-market are recovering some of the over 2.2% declines in the major indices. US yields are higher. The 10 year is up about 6.3 basis points after falling from near 1.70% to 1.47% on Friday. The yields is currently at 1.548%. The USD is mixed in early trading after falling on Friday.

In other marketss:

- Spot gold is trading up $1.74 or 0.10% at $1793.27

- Spot silver is up $0.13 or 0.56% at $23.23

- WTI crude oil futures are trading at $71.70. On Friday the contract traded as low as $67.40

- Bitcoin is trading near $57,000

In the premarket for US stocks, the major indices are recovering some of the declines from Friday's plunge.

- Dow industrial average up at 252 points. On Friday the index fell -905 points

- S&P index up 42.63 points after Friday's -106.84 point decline

- NASDAQ up 183 points after Friday's -353.57 point decline

In the European equity markets, the major indices are also trading higher:

- German Dax, +0.75%

- France's CAC, +1.2%

- UK's FTSE 100 +1.3%

- Spain's Ibex, +1.45%

- Italy's FTSE MIB +1.3%

In the US debt market, yields are higher with the yield curve getting steeper after the sharp flattening on Friday. The 2 – 10 year spread is back up to 100.4 basis points after falling to 96.5 basis points at the close on Friday. The 10 yield yield reach as low as 1.473% after trading as high as 1.691% on November 24.. The current tenure yield is back up to 1.543%.

In the European debt market, the benchmark 10 year yields are rebounding higher as well with the UK 10 year leading the way of +4.5 basis points:

In the European debt market, the benchmark 10 year yields are rebounding higher as well with the UK 10 year leading the way of +4.5 basis points:

November 30, 2021 at 01:05AM

Greg Michalowski

https://ift.tt/3re4uHE

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home