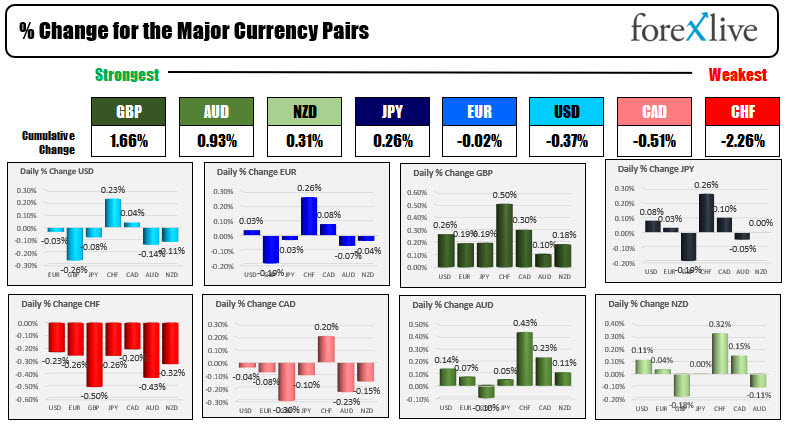

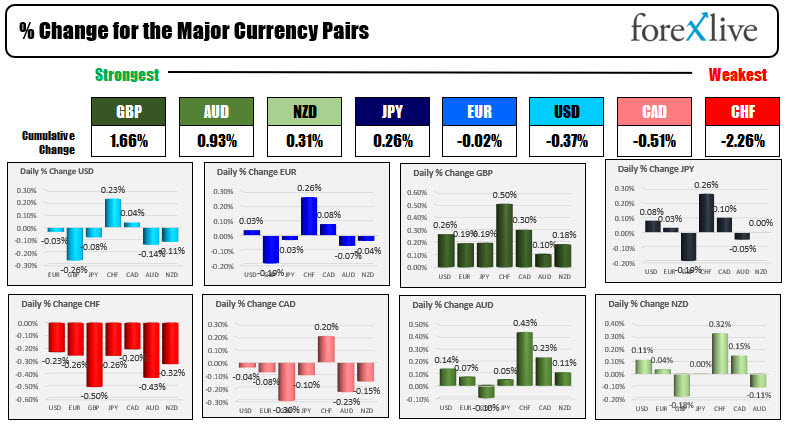

The GBP is the strongest and the CHF is the weakest as NA traders enter for the day

TGIF to all

TGIF to all.

The GBP is the strongest and the CHF is the weakest as North American traders enter for the day. Canadian traders are back from their Remembrance Day holiday. US bond traders are also back in their seats after the Veterans Day holiday. The US dollar was the strongest currency yesterday and the day before. Today it is mixed with a tilt to the downside with modest gains versus the CHF and CAD, and some selling versus the GBP, AUD, NZD, JPY and EUR. US rates are higher in the short end and more subdued in the longer end (30 year is a little lower). The JOLTs jobs data and Michigan sentiment survey will be released in the US. Fed's Williams (NY Fed Pres. and voting member) is to speak. Stocks are higher after a mixed close yesterday with Dow down, S&P near unchanged and Nasdaq up but off highs at the closing bell. Oil is lower and trading around $80 ahead of Baker Hughes later this afternoon. In geopolitical news, Russia and the EU have increase tensions on the back of EU sanctions after economic sanctions in reaction to fraudulent elections and political repression in Belarus. Troops are lining up on the Ukrainian border again prompting the US to warn that Russia may make a move into the country. All of which threatens the oil supply from Russia into the EU. Despite the anxiety, gold prices are dipping in trading today after six straight days of the gains.

- Spot gold is giving back some of its gains seen over the last few days. The stock price is down $8.40 or -0.45% at $1853.

- Spot silver is down $0.23 or -0.93% at $24.99

- WTI crude oil futures are down $1.50 at $80.09

- Bitcoin is trading down $1000 at $63,775

In the US premarket for stocks, the major indices are all trading higher:

- Dow industrial average is up 100.77 points after yesterday's -158.71 point decline

- S&P index is trading up nine points after yesterday's 2.56 point rise

- NASDAQ index is trading up 40 points after yesterday's 81.58 point rise

In the European equity markets, the major indices are trading mixed:

- German DAX, +0.1%

- France's CAC, +0.3%

- UK's FTSE 100 -0.5%

- Spain's Ibex, -0.4%

- Italy's FTSE MIB unchanged

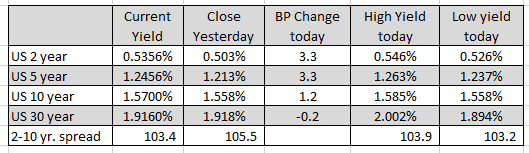

in the US debt market, the two and five year yields are both trading up around 3.3 basis points. The 30 year is trading marginally lower as yield curve flattens a bit. Traders became re-concerned about inflation after Wednesdays CPI data which showed inflation running at the highest level in 31 years. The 10 year yield at 1.570% is still lower than the October high at 1.704% and the end of March yield at 1.774% meanwhile the two year yield at 0.535% is just below the end of October high yield of 0.564%. That yield was the highs since March 2020.

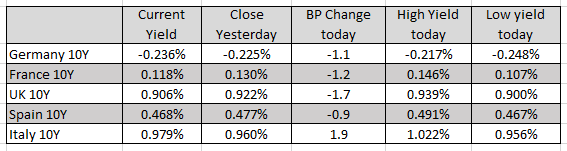

In the European debt market, the benchmark 10 year yields are mostly lower with the exception of Italy (up 1.9 basis points).

November 13, 2021 at 01:04AM

Greg Michalowski

https://ift.tt/3kvOkFm

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home