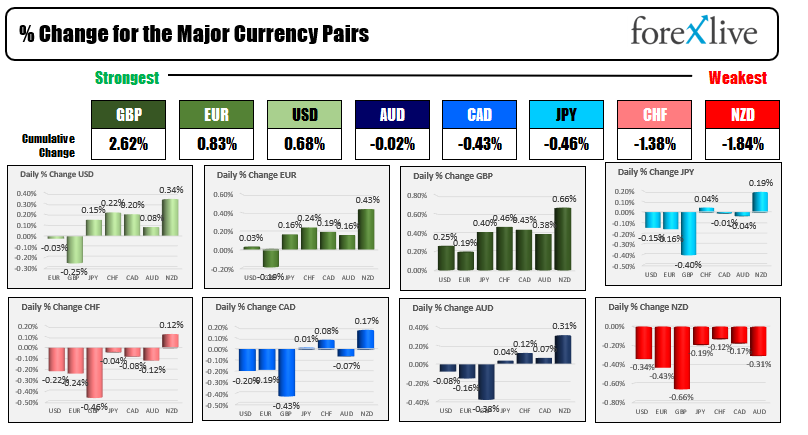

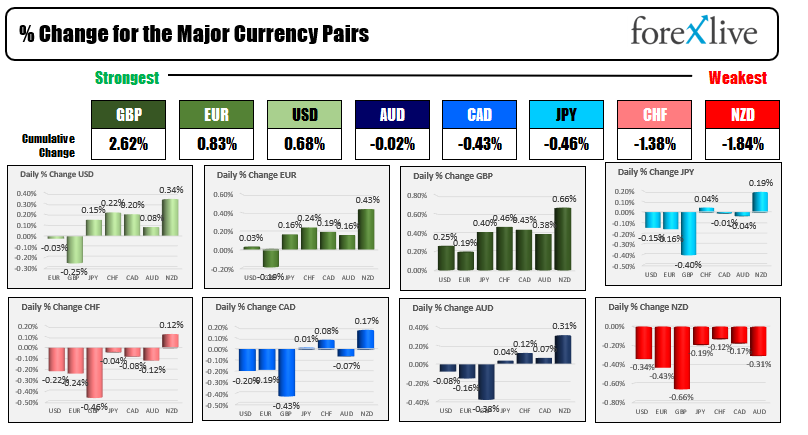

The GBP is the strongest and the NZD is the weakest as NA traders enter for the day

The GBP is the strongest and the NZD is the weakest as NA traders enter for the day

The USD is mostly stronger

The GBP is the strongest and the NZD is the weakest as North American traders enter for the day. The USD is mostly higher with gains vs most of the currencies with the exception of the GBP. The dollar is also little changed vs the EUR and AUD in the morning snapshot. Overnight UK unemployment rate fell to 4.3% from 4.5%, with claimant count change at -14.9K vs -39.2K estimate. The data keeps the hope for a December rate rise and helped to support the GBP . Bitcoin plunged below $60K to a low of $58563 before rebounding back above the $60K level (it currently trades down around -4.3% at $60800). Today, US retail sales will be the highlighted economic release at 8;30 AM ET. Industrial production and capacity utilization will also be released along with business inventories and some NAHB housing data. Fed speak includes Barkin, Bostic, and Daily (all in the US afternoon). US stocks are modestly higher. US yields are modestly lower in early trade.

In other markets, the morning snapshot shows:

- Spot gold is continuing the push higher after small decline yesterday. The price is up $11.02 or 0.59% at $1872.86

- spot silver is up $0.17 or 0.68% at $25.23

- WTI crude oil futures are trading up $0.50 or 0.62% at $81.38

- The price of bitcoin is trading down $3000 at $60,568

- Dow industrial average up 55.55 points, after yesterday's -12.86 point decline

- S&P index up 2.7 points after yesterday's -0.05 point decline

- NASDAQ index is trading up 7.6 points after yesterday's -7.11 point decline

In the European equity markets, the major indices are higher as well:

- German Dax +0.5% (new record)

- France's CAC +0.47% (new record)

- UK's FTSE 100 +0.12%

- Spain's Ibex unchanged

- Italy's FTSE MIB +0.1%

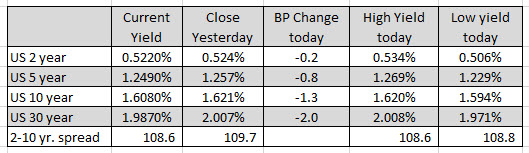

In the US debt market, yields are lower with a slight narrowing of the two – 10 year spread yesterday the yield curve steepened.

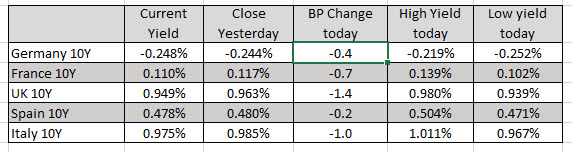

In the European debt market, the yields are also trading lower.

Invest in yourself. See our forex education hub.

November 17, 2021 at 12:49AM

Greg Michalowski

https://ift.tt/3nkh0CS

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home