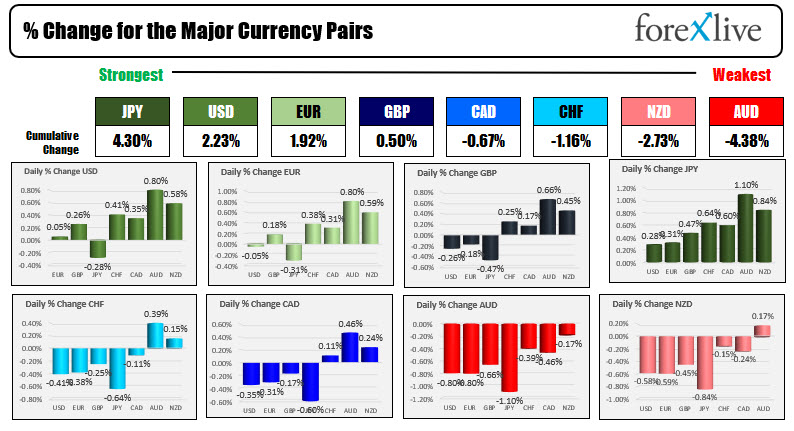

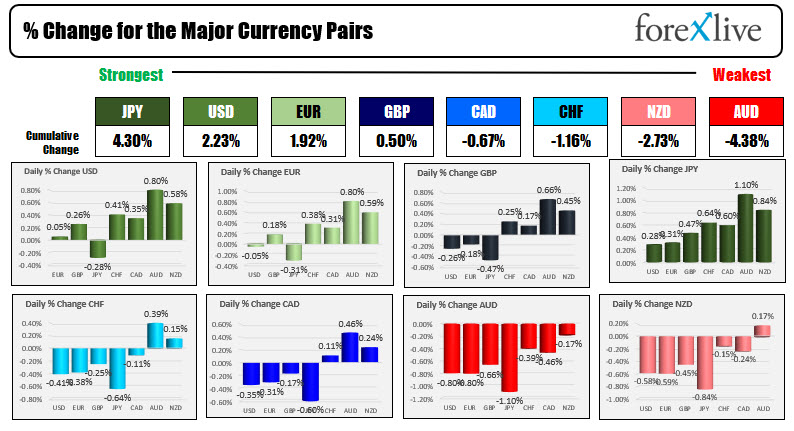

The JPY is the strongest and the AUD is the weakest as NA traders enter for the day

The USD is mostly higher

As North North American traders enter for the day, the JPY is the strongest of the majors while the AUD is the weakest. The Reserve Bank of Australia kept rates unchanged but did say/confirm it had ended targeting the April 2024 Bond at 0.1%. Otherwise it lefts its QE purchase amount of 4bn AUD per week unchanged. The statement expressed the Bank was remaining patient on developments in the economy and said it needed to see wage growth ahead (repeating this for the umpteenth time). RBA's Lowe did say "It is now plausible that rate hike could be appropriate in 2023" but also hedged that statement by adding "It is also entirely possible that cash rate remains at current level until 2024". The AUDUSD is back down testing the lows from Oct 18, and 22 at 0.7453 area. The USD is mostly higher with declines in the morning snap shot only vs the JPY. The USD is near unchanged vs the EUR and recovering vs the GBP. The USDCHF which trended lower yesterday, is higher today and works back toward its 100 hour MA at 0.91408 (high reached 0.9130 after falling to 0.9081.

In other markets:

- Spot gold is down $4.44 or -0.25% at $1788.92.

- Spot silver is down $0.19 or -0.82% at $23.83

- WTI crude oil futures are trading down $0.60 or -0.75% at $83.32

- Bitcoin is trading higher at $63,300 that's up about $2300 on the day

In the premarket for US stocks, the major indices are mixed after record closes for all three major indices yesterday. The futures are implying:

- Dow industrial average is up 43.16 points

- S&P index is up 1.75 points

- NASDAQ index is down -27 points

In the European equity markets, the major indices are trading mixed:

- German DAX, +0.5%

- France's CAC +0.2%

- UK's FTSE 100, -0.6%

- Spain's Ibex, -0.5%

- Italy's FTSE MIB -0.3%

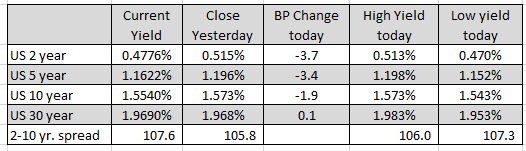

In the US debt market, the yields are mostly lower with a steeper yield curve. The two year yield is down -3.7 basis points

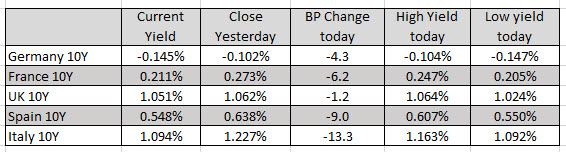

In the European debt market, the benchmark 10 year yields have moved back to the downside led by a rally in the Italian 10 year bond price (lower yield by -13.3 basis points).

November 03, 2021 at 12:18AM

Greg Michalowski

https://ift.tt/3w7cieF

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home