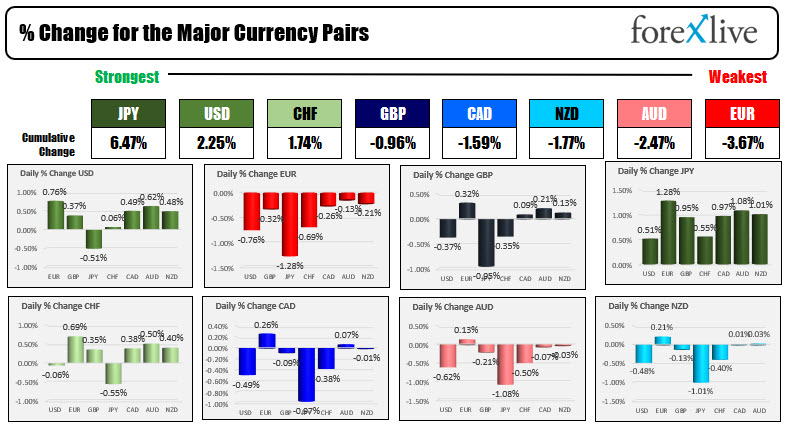

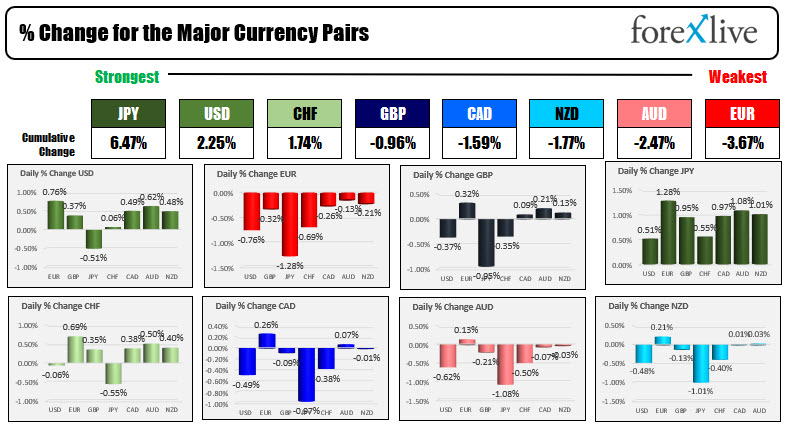

The JPY is the strongest and the EUR is the weakest as NA trading gets underway

The USD is mostly higher to start the North American session

The JPY is the strongest and the EUR is the weakest as the NA trading gets underway. TGIF to all, which means price action can be influenced by end of week flows and increased volatility.

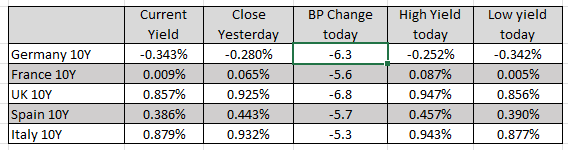

The USDJPY is running lower (as is JPY pairs with the EURJPY now down -1.28%). In Europe, the EUR is reacting to the Covid case increases and the risk of a new set of lockdowns as a result (Austria announced they will lockdown and impose a broad vaccine mandate). That has European yields down sharply.

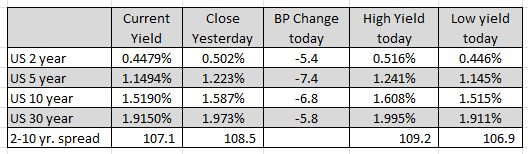

US yields are lower as well despite worries about increasing inflation, but having said that, the worry is being helped by another drop in the price of crude oil which is trading at near $76. Recall the price of oil peaked at $85.38 (down near -11% from the high). Will the declines take some of the pressure off the inflation run up?

- Spot gold is trading up $3.84 or 0.21% at $1862.42

- Spot silver is down three cents -0.10% at $24.75

- WTI crude oil futures are trading down below $76 and $75.80

- Bitcoin is trading near unchanged $57,187 after moving sharply lower yesterday

In the premarket for US stocks, the down Jones industrial average is down sharply while the NASDAQ index is higher. Both the S&P and the NASDAQ index closed at record level yesterday. US financials are moving lower, as our energy equities. The futures are implying:

- Dow industrial average -250 points after yesterday's -60.10 fall

- S&P index -14 points after yesterday's 15.87 point rise in new record

- NASDAQ index up 68 points after yesterday's 72.14 point rise

In the European equity markets, the major indices are moving to the downside on slowed on concerns:

- German DAX, -0.34%

- France's CAC, -0.8%

- UK's FTSE 100 -0.7%

- Spain's Ibex -1.6%

- Italy's FTSE MIB -1.4%

In the US debt market, the yields are following the downward tumble in oil prices:

November 20, 2021 at 12:58AM

https://ift.tt/3DyGulZ

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home