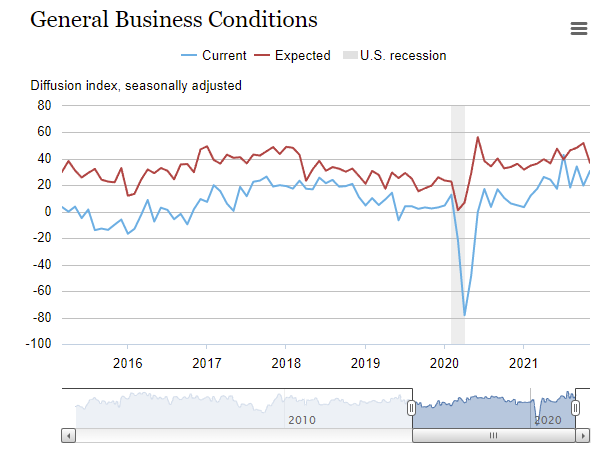

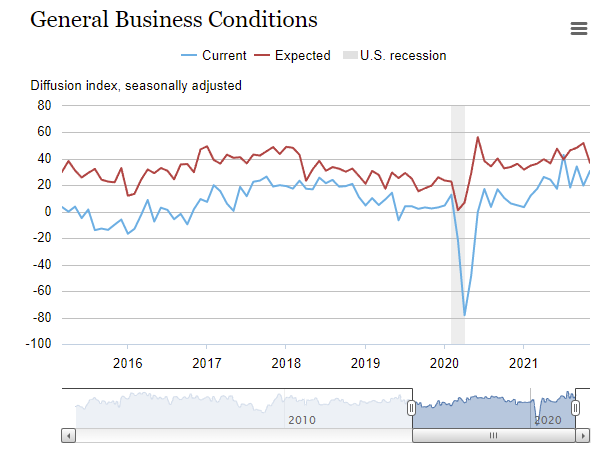

US November Empire manufacturing index 30.9 versus 22.0 estimate

New York Fed Empire manufacturing index for November 2021

- Prior report. The index fell to 19.8 in October from 34.3 in September (the estimate was 27.0).

- New orders 28.8 versus 24.3 last month

- Prices paid 83.0 versus 78.7 last month.

- Prices received 50.8 versus 43.5 last month. Record high for prices received

- Employment 26.0 versus 17.1 last month. Record high.

- Average workweek 23.1 versus 15.3 last month.

- Shipments 28.2 versus 8.9 last month.

- Unfilled orders 12.7 versus 18.5 last month.

- Delivery time 32.0 versus 38.0 last month.

- Inventories 9.3 versus 12.0 last month.

The six month business condition index for October 2021 fell to 36.9 versus 52.0 last month as manufactures sour on the expectations going forward

- new orders 34.4 versus 51 last month

- prices paid 72 versus 67.6 last month

- prices received 55.9 versus 50.0 last month

- number of employees 30.6 versus 37.1 last month

- average employee workweek 10.2 versus 10.2 last month

- shipments 32.2 versus 52.3 last month

- unfilled orders 5.9 versus 0.9 last month

- delivery times 12.7 versus 5.6 last month

- inventories 11.9 versus 17.6 last month

- capital expenditures 34.7 versus 31.5 last month

- technology spending 28.0 versus 26.9 last month

From the NY Fed:

New orders and shipments posted substantial increases, and unfilled orders rose. Delivery times were significantly longer. Employment grew at its fastest pace on record, and the average workweek increased. The prices paid index held near its record high, and the prices received index reached a new peak. Firms planned significant increases in capital and technology spending. Looking ahead, firms remained optimistic that conditions would improve over the next six months, though optimism dipped.

On a six month forward-looking basis, the New York Fed said:

Firms were less optimistic about the six-month outlook than they were last month, with the index for future business conditions falling fifteen points to 36.9. The indexes for future new orders and shipments fell to similar levels. Longer delivery times, higher prices, and increases in employment are all expected in the months ahead. The capital expenditures index climbed three points to 34.7, and the technology spending index ticked up to 28.0, suggesting that firms plan significant increases in both capital spending and technology spendingThere is little reaction to the report in the forex market. US stocks remain higher with the futures implying the Dow industrial average now up 147 points. The NASDAQ index is implying a 66 point gain. While the S&P futures are implying a 17 point gain.

November 16, 2021 at 01:30AM

https://ift.tt/3niqdvA

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home