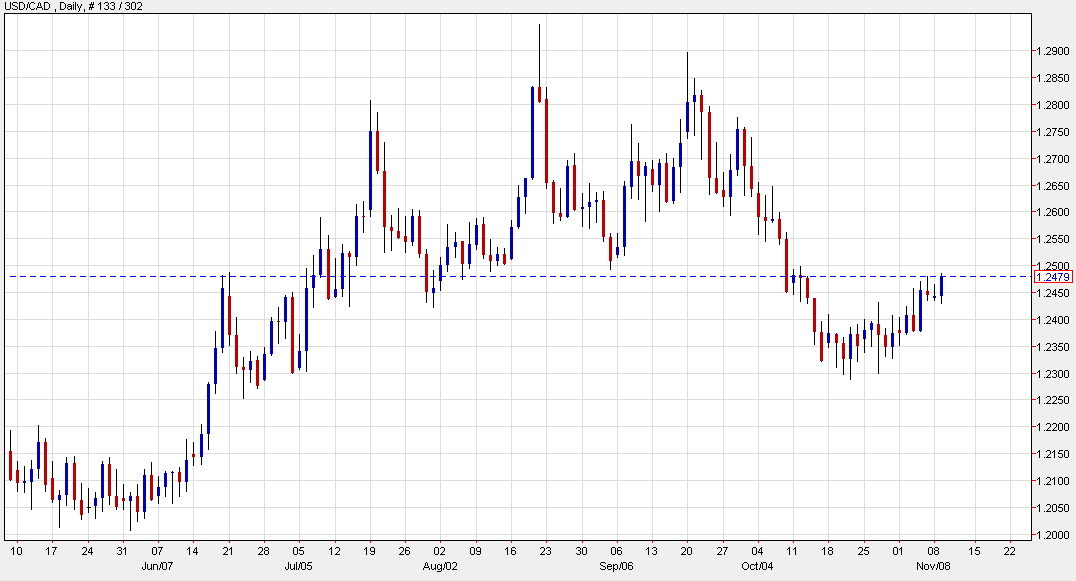

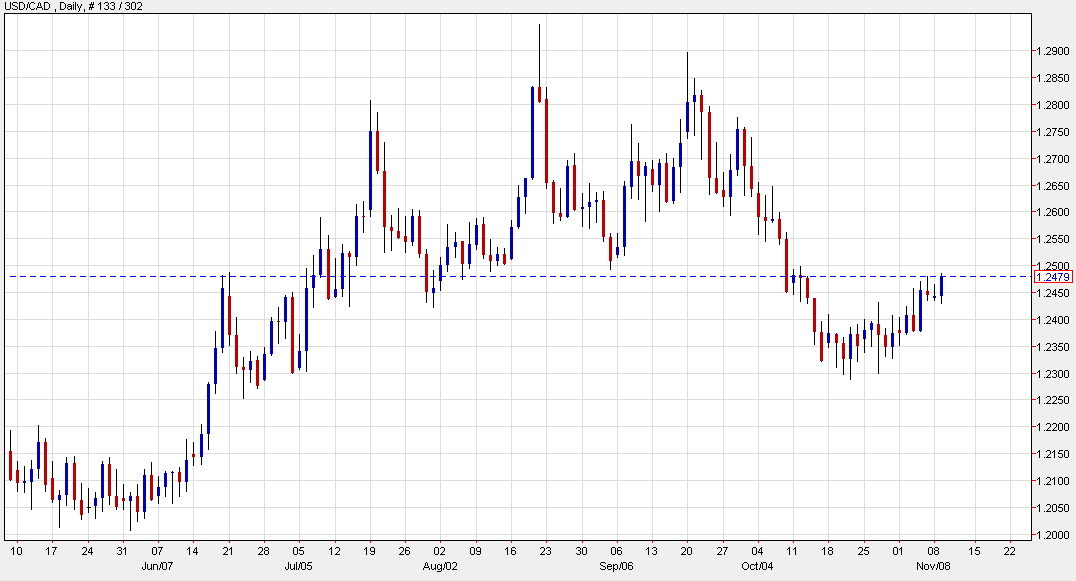

USD/CAD spikes as broad US dollar bid rolls through

Risk aversion hits markets

A drop in equities has led to a quick risk-off style move in FX as the US dollar and yen rally against other currencies. The commodity currencies are being hit hard with the loonie jumping 38 pips to 1.2476.

Oil has been surprisingly resilient in the latest round of worries but natural gas is down 6.3%. The pop in USD/CAD is the highest in four weeks and is back to within striking range of the key 1.2500 level.

The takeaway for me at the moment is just how jittery the broad market is. A dip in Tesla shares triggered a mini run to the exits and that quickly spilled into FX. It's like everyone is long but ready to bail at the slightest hint of pain. That's the kind of market psychology that can lead to a rout.

November 10, 2021 at 03:18AM

Adam Button

https://ift.tt/3kikjJa

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home