USDCHF extends back above its 100 hour moving average

A pickup and dollar buying in the early North American session

The US dollar has seen a pickup in the buying over the last few minutes of trading.Crude oil is lower. Gold is also moving to the downside ($-18 currently). US yields have also seen some modest most of the upside. The two and five year yields are now positive on the day after being negative earlier. The 10 year is moving toward near unchanged.

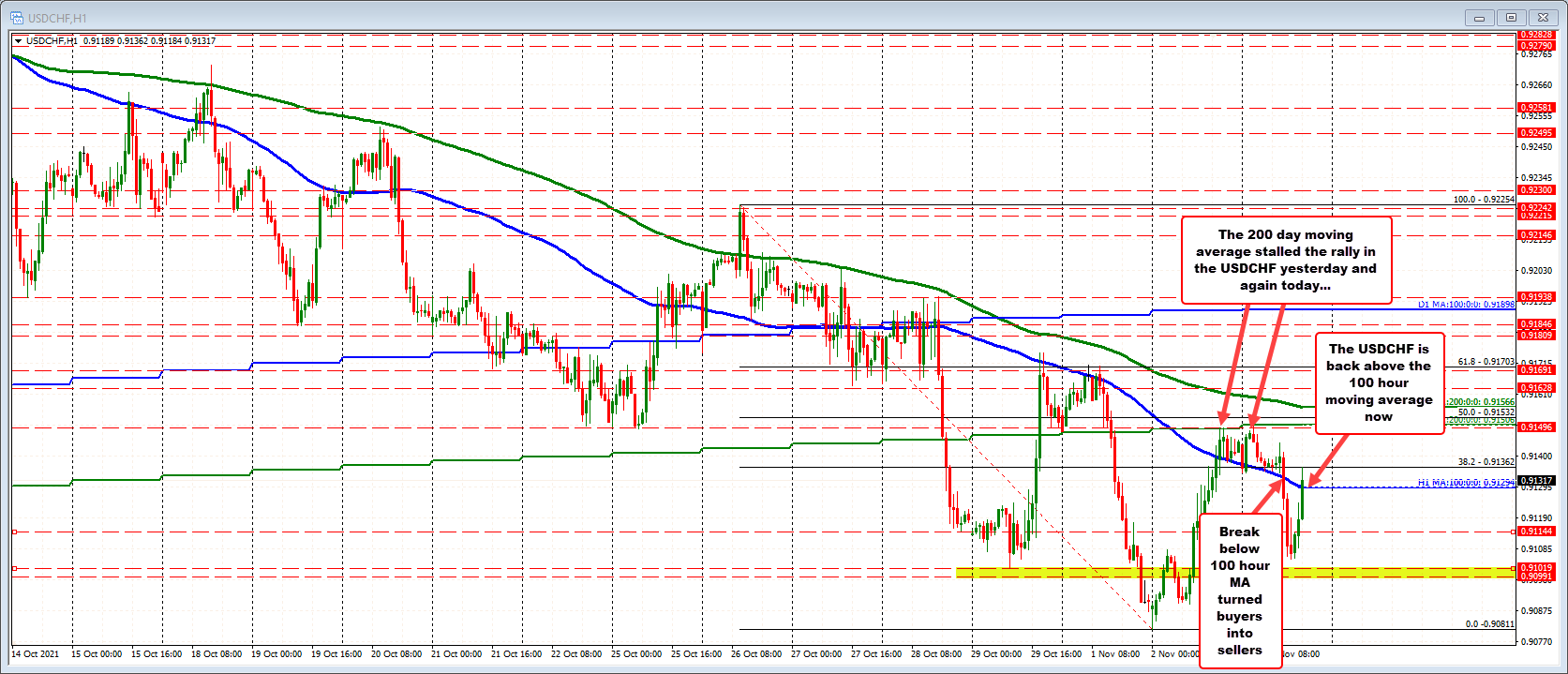

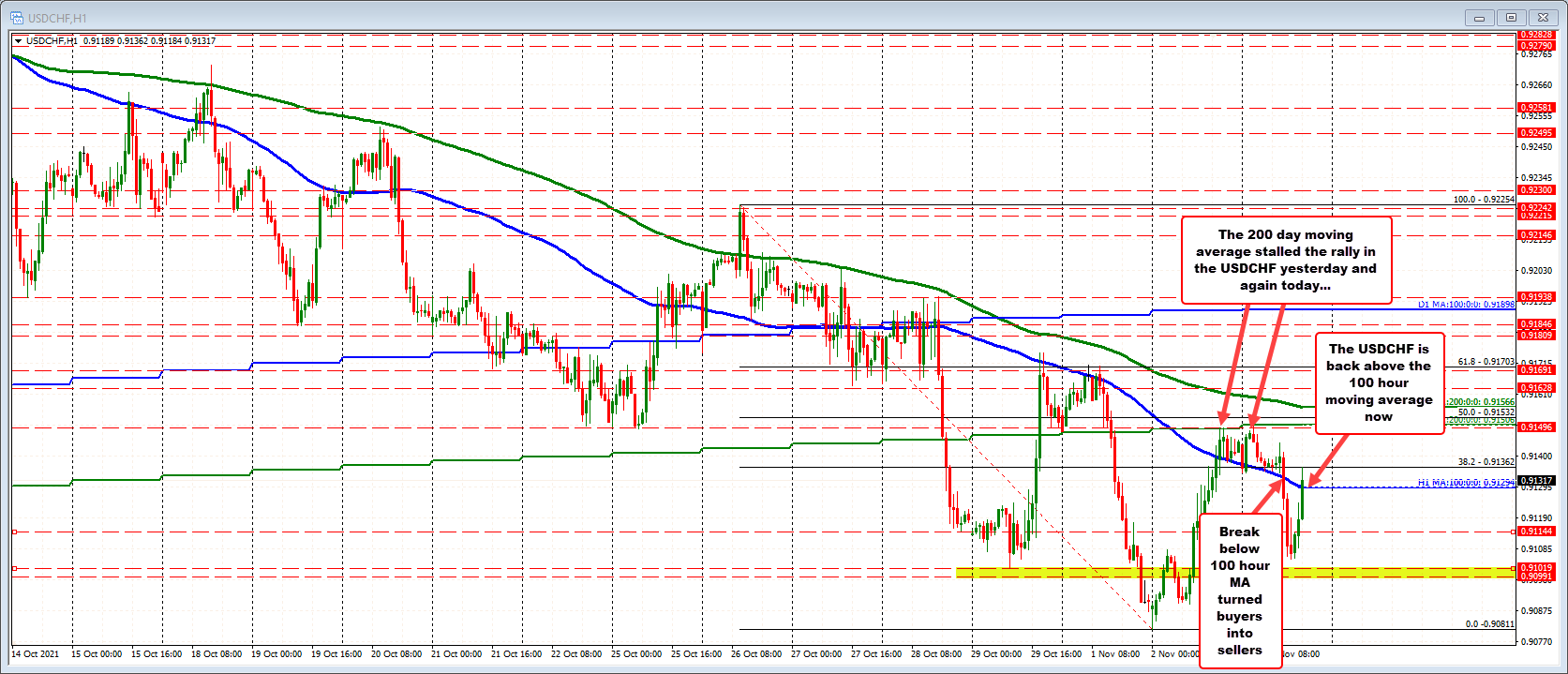

Looking at the USDCHF, the the pair just moved back above its 100 hour moving average at 0.91294 and testing the 38.2% retracement of the move down from last week's high at 0.91362.

If anything, the move to the upside in this currency pair this morning has taken the price back toward a more neutral area near the falling 100 hour moving average ahead of the FOMC decision later this afternoon.

Although the price moved back above the 100 hour moving average, the high price from yesterday and again today stalled against a key resistance level at the 200 day moving average at 0.91508.

Going forward (and through the FOMC), the price would need to get above that 200 day moving average as well as the falling 200 hour moving average at 0.91566, to give buyers more confidence. Absent that and the sellers still have more control.

On the downside, the 0.91144 level is the 50% midpoint of the 2021 trading range. Below that, there was support in August right at the 0.9100 level (last week, the price also stalled just ahead of that level). Finally, the upward sloping trendline stalled the falls both yesterday and on Monday. That trendline currently comes in at 0.9085.

The cluster of support on the daily chart between 0.9085 and 0.91144 would all need to be broken in succession to increase the bearish bias.

November 04, 2021 at 01:38AM

https://ift.tt/3jXxGyb

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home