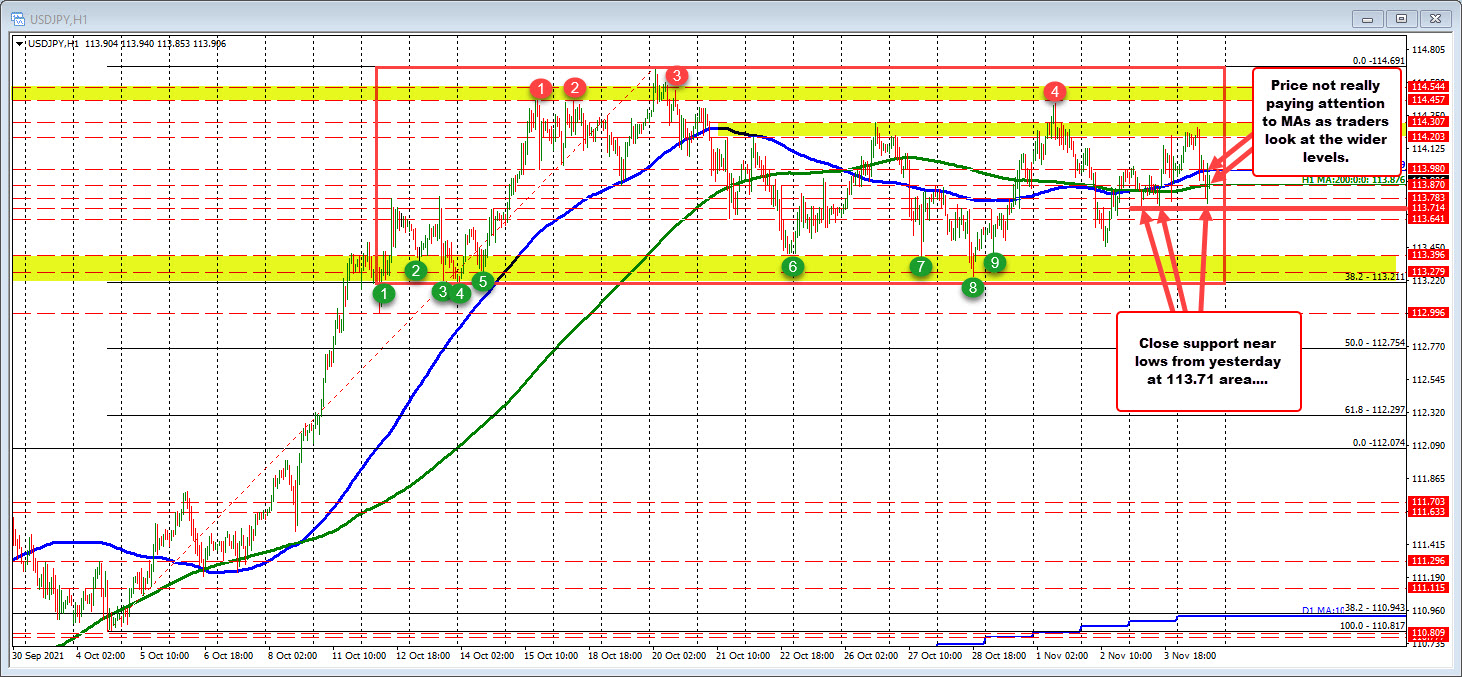

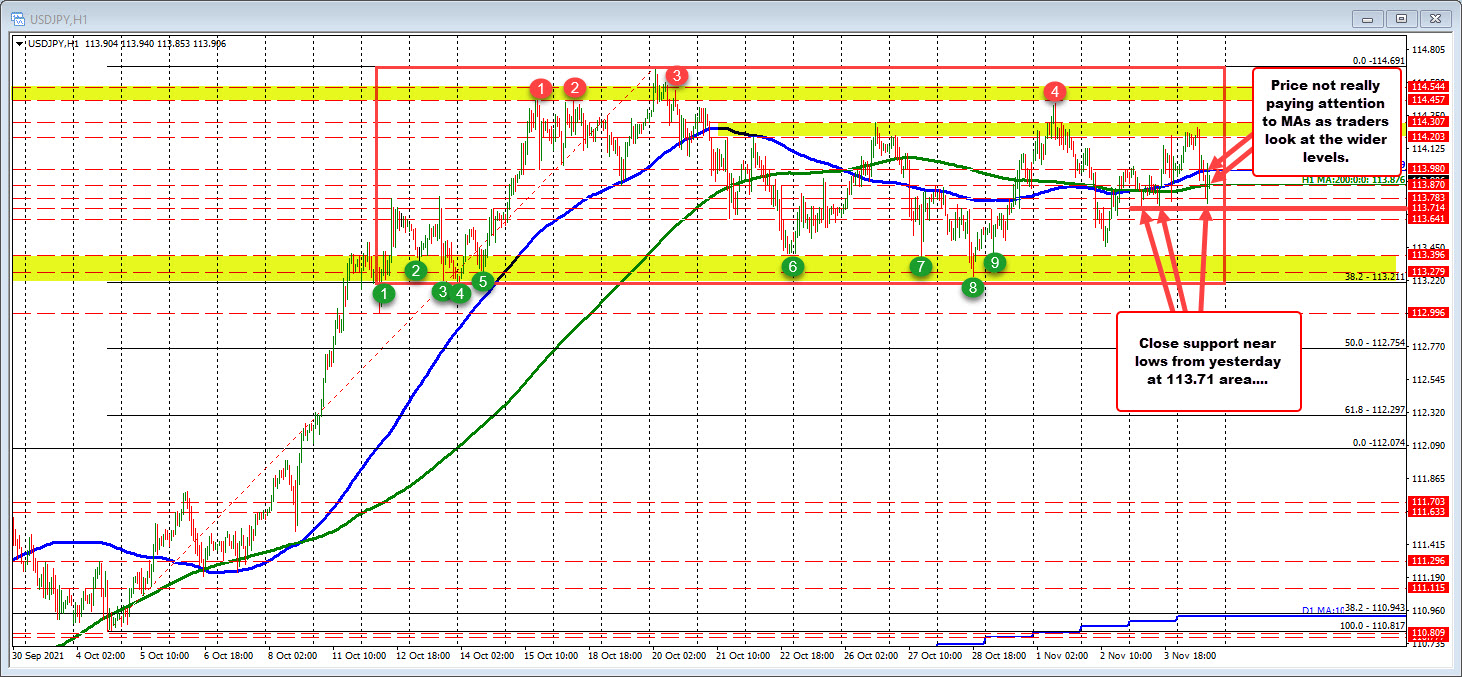

USDJPY remains confined in trading range as traders look for look for directional bias

The 100/200 hour MA are being ignored as the traders remain unsure as to the directional bias for the pair

The USDJPY remains confined in a trading range as traders continue to look for a directional bias.

The uncertainty has the pair trading near the middle of the range going back to October 12. That range has a low near the 38.2% retracement at 113.211, and a high from the October 20 swing high at 114.69.

A lower swing high area comes near 114.457 to 114.54. The lower swing low area comes between 113.211 and 113.396.

In between those extremes sits the 100 and 200 hour moving averages (blue and green lines). Market traders are starting to ignore those moving averages (the price is chopping above and below them) as traders look for a more trend like bias for the pair fundamentally and technically. Recent highs have been lower (from November 1) but recent lows (from October 28) have been higher as well, which helps to muddy the water.

Nevertheless at some point, the price will look to get out of this quagmire.

On the topside watch the 114.20 to 114.307. Move above that level and look for momentum.

On the downside the lows from yesterday and today near 113.71 is close support. Get below 113.641 as well and traders could push toward the lower swing levels.

Getting outside the lower and higher extremes will then be targeted (depending on the break direction). For now, with the price trading near 113.86, it is marginally bearish but the price can go either way.

November 05, 2021 at 01:33AM

Greg Michalowski

https://ift.tt/3BKqkUE

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home