SNB intervention and the EURCHF

SNB

Leaning on a spear can be a similar analogy to relying on the SNB to intervene in the EURCHF exchange rate. In January 2015 the SNB famously stepped back from defending the 1.2000 peg and the pair fell dramatically.However, despite this unreliable past the SNB still to regularly intervene in the EURCHF pair by buying euros and dollars to try and weaken the CHF.

SNB's Maechler

Last week SNB's Maechler repeated that the SNB can always intervene in the currency market, but is not focusing on a particular level of the franc. Maechler said . 'We are always prepared to intervene in foreign exchange markets if needed". However she said that "We don't have a specific exchange rate in our minds, neither in terms of level nor in terms of pairs".

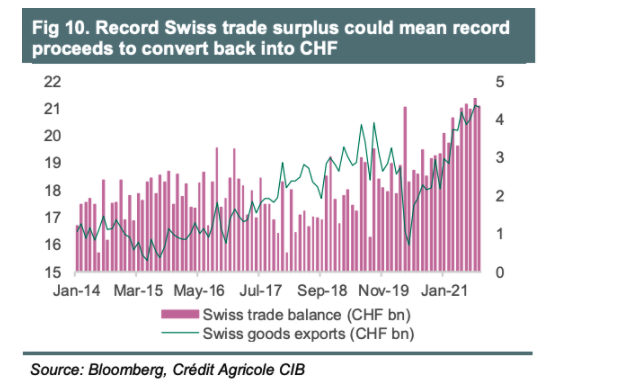

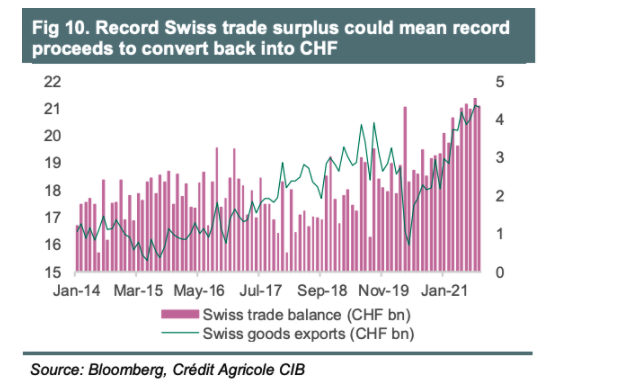

The recent strength in the CHF has been quite marked. The large trade surplus has been helping to drive it.

Omicron fears

The latest omicron fears have been weighing on the EURCHF pair as more flows have come into the CHF. However, the issue now is just how serious the omicron variant is. If this fades away it could be worth looking at the EURCHF for some recovery. However, the strength in the CHF was building even before the variant news broke, so it still may be premature to jump in. However, it is just worth being aware of the pair as if /when we see a recovery in the eurozone and global growth prospects the EURCHF should be a good beneficiary. So, not a trade for today, but one pair to keep monitoring.

December 01, 2021 at 10:36PM

Giles Coghlan

https://ift.tt/3xO8yj1

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home