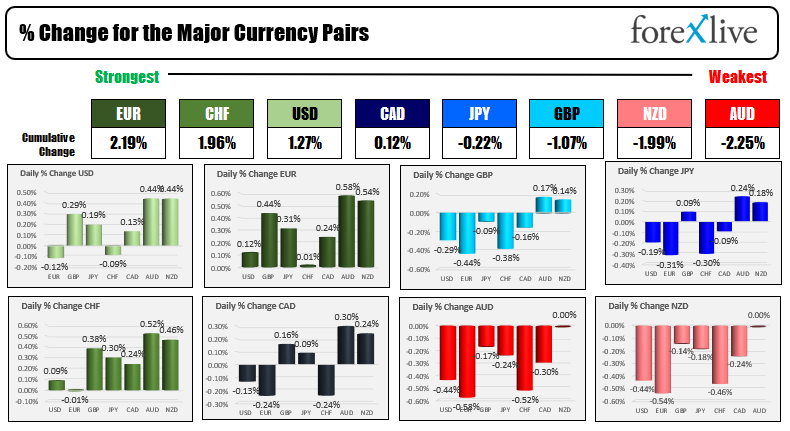

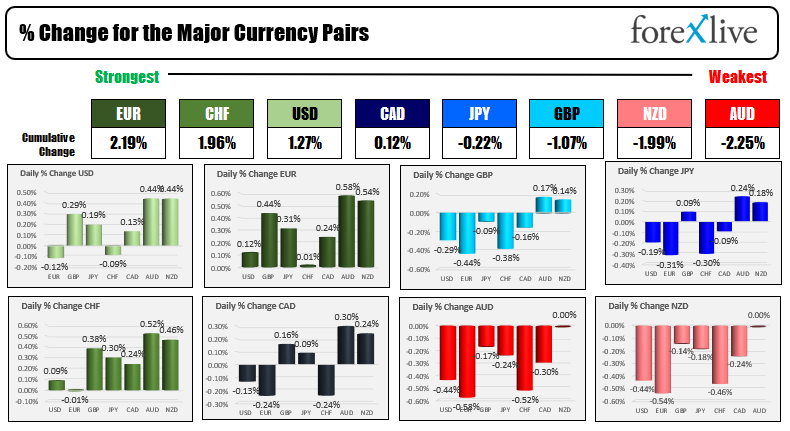

The EUR is the strongest and the AUD is the weakest as NA traders enter for the day

The USD is higher ahead of the US jobs report

The EUR is the strongest and the AUD is the weakest as the NA traders enter for the day. The USD is mostly stronger (it is marginally lower vs the EUR and the CHF) vs the major currencies ahead of the US jobs report which will be released at 8:30 AM ET/1230 GMT. The largest gains for the USD have come vs the AUD and NZD.

The US jobs (550K est.) and Canada jobs report (+36.5K est) will be the highlighted economic releases for the day. The US ISM services PMI (est 64.9 vs 66.7 last month), and Factory Orders (est 0.5% vs 0.2% last month) will also be released at 10 AM ET/1400 GMT. The weekly Bakers Hughes rig count will be released later this afternoon.

US stocks are little changed in early trading after closing sharply higher and stopping the 2-day decline yesterday. Nevertheless, the major indices are on pace to close lower on the week. European shares are playing catch up and higher in morning trading.

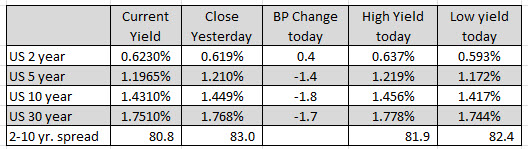

Yields in the US are unchanged to lower with the yield curve flattening further.

Oil futures are higher after OPEC+ said yesterday that they would keep the production plans intact in January, but did also say that that plan can change given conditions (i.e. omicron reduction in demand). For now the expectations are for a 400K BDP increase in production in January (assuming members can meet their quotas).

The transmission rate of omicron is higher than other variants and has some immune evasions. The impact could lead to slower growth and/or a tighter labor market as workers (especially in the lower paying jobs) choose to not work vs work.

A snapshot look at other markets at the start of the US session is showing:

- Spot gold is trading up four dollars or 0.22% at $1772

- Spot silver is up two cents or 0.09% at $22.37

- WTI crude oil is trading up one dollar at $68.40

- Bitcoin is trading just under $57,000 of $56,960

In the premarket for US stocks, the major indices are little changed after yesterday's rebound higher:

- Dow industrial average is up 23 points after yesterday's 617.75 point surge

- S&P index is up 2.8 points after yesterday's 64.06 point rise

- NASDAQ index is up 20 points after yesterday's 127.27 point advance

In the European equity markets, the major indices are also higher:

- German DAX, +0.3%

- France's CAC, +0.15%

- UK's FTSE 100 +0.4%

- Spain's Ibex, +0.25%

- Italy's FTSE MIB, +0.4%

In the US debt market, 2 year yields are up marginally, while the 10 and 30 year yields are down as the yield curve continues to flatten. The 2-10 year spread is around 81 pips today.

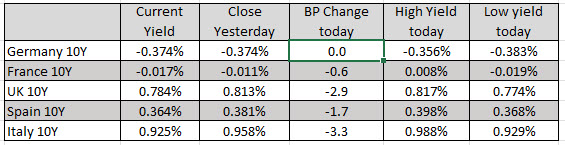

In the European session, the benchmark 10 year yields are also lower. Francis 10 year is back below the 0.0% level at -0.017%.

December 04, 2021 at 12:52AM

Greg Michalowski

https://ift.tt/3pn4PVU

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home