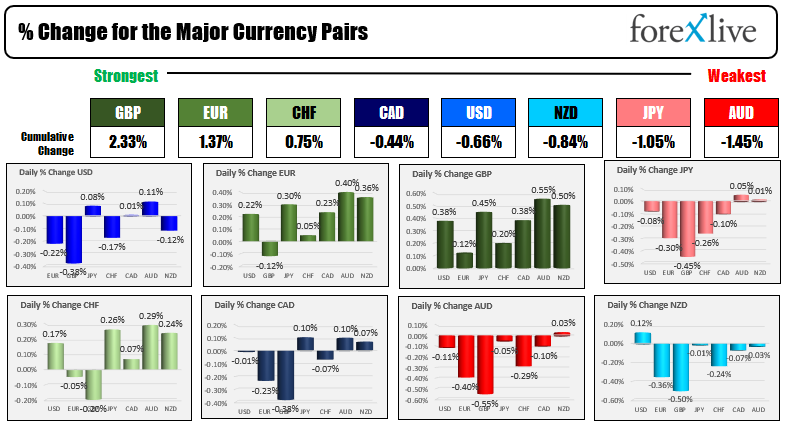

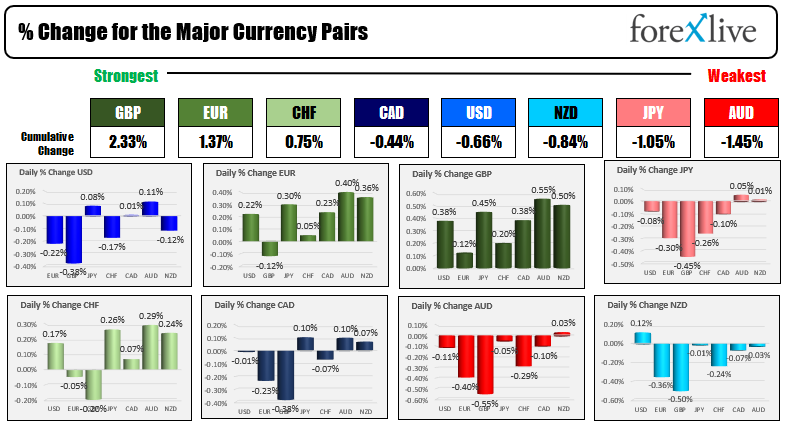

The GBP is the strongest and the AUD is the weakest as NA traders enter for the day

The USD is tilting lower. What is ahead in the US markets today.

The GBP is the strongest and the AUD is the weakest as the North American session begins. OPEC+ meeting will be a highlight today, along with the weekly initial jobless claims data and Fed speak.

OPEC+ could keep the pace of 400K production increases in play, or lower increases to 200K or stop the production increases all together in reaction to omicron concerns. All options are on the table as ministers meet.

The claims data will be the latest look at US jobs ahead of the monthly jobs report tomorrow from the BLS. That report is expected to show a job gains of 553K (vs 531K last month). The claims is expected to come in at 238K vs last weeks dip to 199K.

Fed speak will be highlighted by Bostic, Quarles, Barkin and Daly who are all scheduled to speak. Chair Powell reaffirmed his shift to a faster taper and concerns about inflation that could lead to earlier tightenings.

Stocks are set to open mixed with the Nasdaq lower on the day. Apple shares are lower (near 3% in premarket trading) on the back of slower sales due to supply constraints.

The flattening of the US yield curve continues as markets setup for a tighter Fed policy.

The omicron variant news knocked stocks lower yesterday, and that storyline will play out in real time going forward as the market reacts to the latest news headlines (rightly or wrongly). The announcement of the initial case in the US yesterday, sent stocks into a tumble yesterday with the major indices closing at/near session lows. US has tightened travel requirements for overseas travelers to the US.

A snapshot of other markets are showing:

- Spot gold is trading down $1.22 at $1780.53

- Spot silver is up $0.18 or 0.82% at $22.48

- WTI crude oil futures are trading at $65.69. The low for the day has reached $65.15 while the high extended up to $67.31. Once again OPEC+ will be a major influence

- The price of bitcoin has moved back below the $57,000 level at $56,559. The price has dipped as low as $55,839 in trading today

In the premarket for US stocks, the major indices are mixed with the Dow higher while the NASDAQ index is lower. All major indices closed at or near low levels yesterday. The Dow industrial average had a near 1000 point trading range from high to low.

- Dow industrial average +207 points after yesterday's -461.68 point decline (-1.34%)

- S&P index up 11 points after yesterday's -53.98 point decline (-1.18%)

- NASDAQ index -26 points after yesterday's -283.64 point decline (-1.83%)

in the European equity markets, the major indices are all trading in the red:

- German Dax -1.8%

- France's CAC -1.6%

- UK's FTSE 100 -1.0%

- Spain's Ibex -2.0%

- Italy's FTSE MIB -1.7%

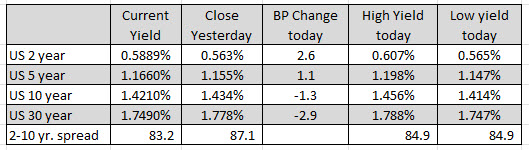

In the US debt market, the two year yield is higher by 2.6 basis points while the 10 year yield is down -1.3 basis points. The 2– 10 year spread is down to 83.2 basis points from around 87.1 basis points yesterday. He continues to contract as traders price and Fed tightenings, and slower growth as a result.

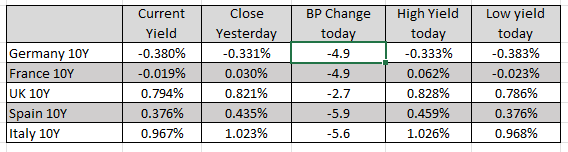

A snapshot of the benchmark 10 year yields in Europe are showing declines across the board:

December 03, 2021 at 01:01AM

https://ift.tt/31nDbzy

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home