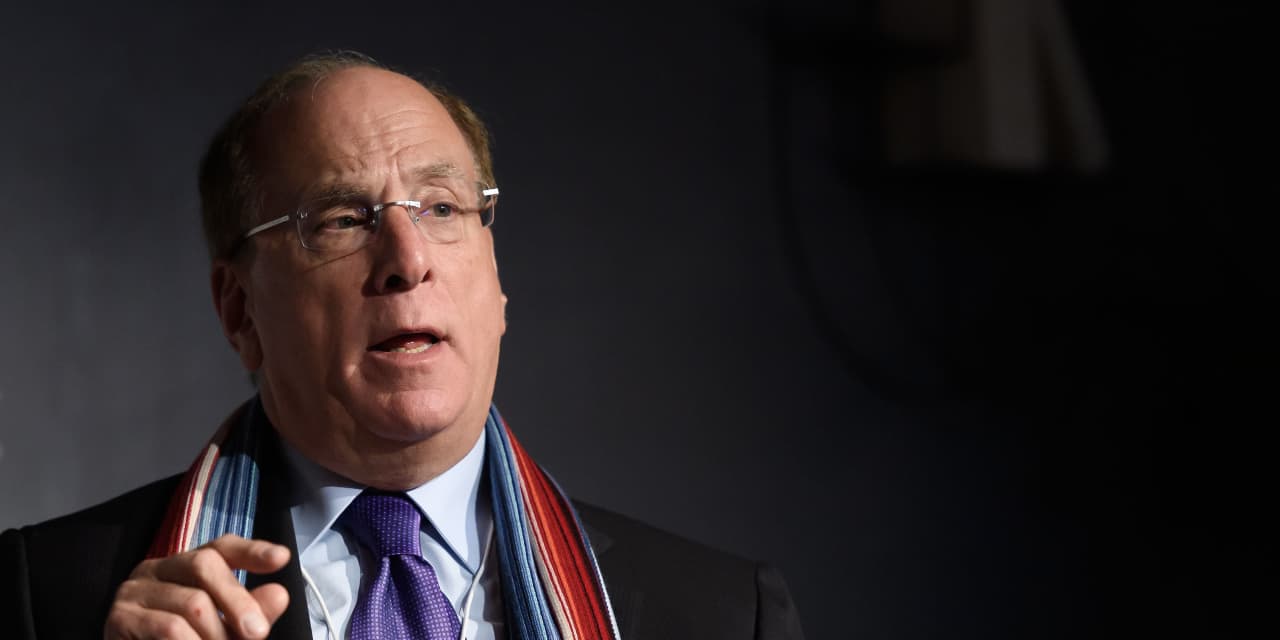

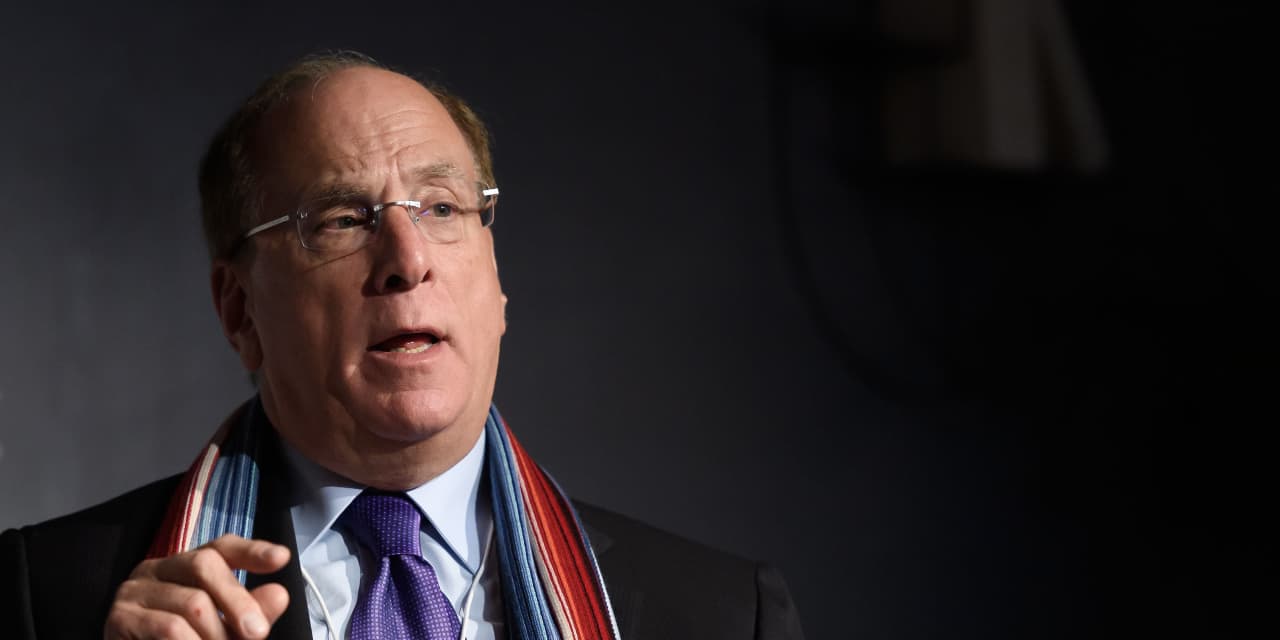

: BlackRock’s CEO says a leading investor is flagging worries about valuations and inflation

BlackRock Chief Executive Larry Fink on Tuesday said a leading investor flagged to him concerns about stock market valuations and the possibility of inflation breaking out.

Fink, speaking on a webinar presenting the fund manager’s 2021 outlook, said he had a conversation with “one of the largest investors in Asia,” which he did not identify.

“They’re worried about some of the equity valuations right now, but they’re also somewhat concerned about the impact of rising inflation,” said Fink, who heads the world’s largest asset manager with $8.7 trillion in assets under management. “Should interest rates go higher before they jump back into fixed income?”

Federal Reserve Chair Jerome Powell last week said it is way too early to talk about making any changes to the central bank’s easy monetary policy stance, including its $120 billion a month bond-buying program. “There is plenty of slack in the labor market and it’s unlikely that wages pressures are going to be reaching a level that would create and support higher inflation,” the Fed chair said.

Fink doesn’t sound so sure.

“Right now the bond market is starting to say we’re going to start seeing rising inflation, we’re going to have a more robust economy in six to 12 months,” said Fink. “And if the forward curve of the bond market is correct, one could expect in nine months or 12 months at the very least, the Federal Reserve and other central banks starting to re-evaluate their monetary policy.”

As for valuations, Fink said “there are parts of the equity markets that are probably mispriced” with “ridiculous” price-to-earnings ratios. “These are just giant momentum trades. We see this time and time again.”

He did point out that over the last 12 months, there was a lot more money going into bonds, and as a result, most investors are still underweighted equities.

As for his own business, Fink says increasing data analytics will allow for the creation of more customized portfolios using sustainable or social attributes. “If you haven’t focused on what sustainability means for your portfolio, I would urge you to start thinking about it rapidly, because this is happening.”

January 19, 2021 at 10:35PM

http://www.marketwatch.com/news/story.asp?guid=%7B21005575-02D4-D4B5-4572-D20A1D967421%7D&siteid=rss&rss=1

Labels: Top Stories

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home