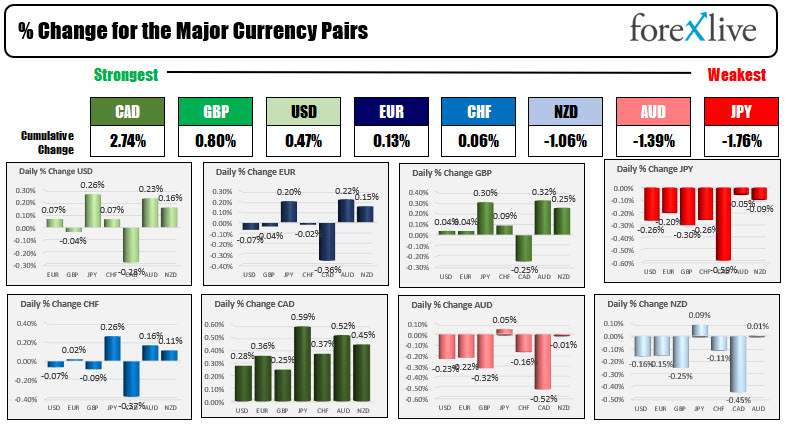

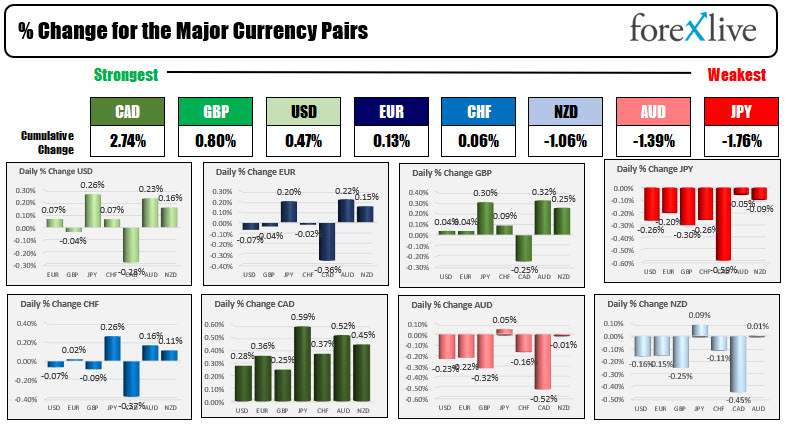

The CAD is the strongest and the JPY is the weakest as NA traders enter for the day

The USD is modestly stronger ahead of the FOMC decision today

The CAD is the strongest and the JPY is the weakest. Canada CPI will be released at the bottom of the hour. The USD is marginally higher and working through the earnings from Microsoft, Apple and Alphabet which each beat expectations (combined they had app. $57B of earnings which were nearly double year earlier levels and 30% above expectations - wow), and with an eye toward the Fed decision at 2 PM ET where policy will remain unchanged, but risk of taper talk is always possible. US trade and inventory data will be released at the bottom of the hour. The oil inventory data will be releasesd as well. The private data showed a larger than expected drawdown of -4.728M vs -2.55M estimate in the oil data near the close yesterday.

In other markets:

- Spot gold is trading near unchanged at $1798.32

- Spot silver is up $0.11 or 0.48% $24.78.

- WTI crude oil futures are up $0.23 or 0.32% at $72.11

- Bitcoin is trading at $40,720.61. That's up some $1200 on the day

In the premarket for US stocks, the major indices are trying to recover after yesterday's sharp declines:

- Dow up 5.48 points after yesterday's -84.67 point decline

- NASDAQ index up 51 points after yesterday's -180 point decline

- S&P index up 2.5 points after yesterday's -20.6 point decline

- German DAX +0.2%

- France's CAC, +0.7%

- UK's FTSE 100, +0.1%

- Spain's Ibex, +0.4%

- Italy's FTSE MIB, +0.6%

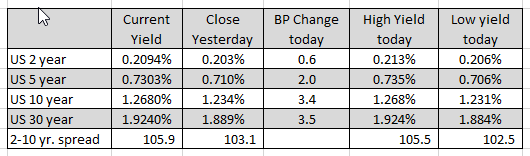

in the US debt market, yields are higher with the longer and moving up the most. The 10 years up 3.4 basis points. The 30 years up 3.5 basis points. There will be no auctions today as the Federal Reserve meeting pushes the seven year note auction to Thursday.

July 29, 2021 at 12:21AM

Greg Michalowski

https://ift.tt/3zK0BLz

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home