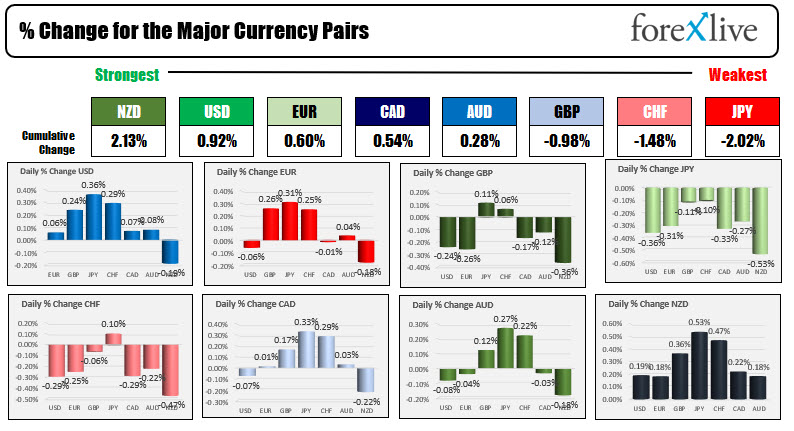

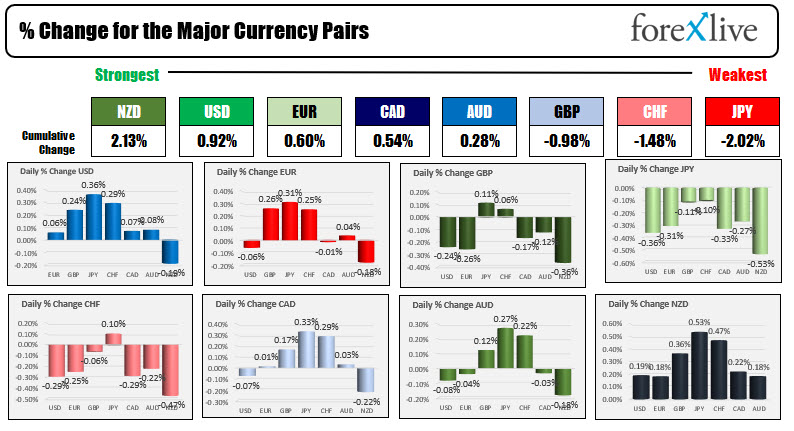

The NZD is the strongest and the JPY is the weakest as NA traders enter for the day

The USD is mostly stronger with gains vs the JPY and CHF leading the way

As the North American session begins, the NZD is the strongest, and the JPY is the weakest. Yesterday the GBP was the strongest at the close while the EUR and CHF were the weakest (the USD traded up and down but ended marginally lower). The USD today is mostly higher with the gain vs the JPY (+0.36%) leading the charge to the upside. The greenback versus the EUR, CAD and AUD are modestly higher by 0.08% or less. The dollar is down -0.19% vs the NZD to start the day. US stocks are higher in premarket trading with the Dow up about 170 points. The NASDAQ index is up around 50 points. Major indices are up three days in a row after Monday's sharp declines. Snap and twitter both announced earnings after the close yesterday and are sharply higher, raising media concentrated Facebook and Google shares in anticipation of their earnings next week. US rates are higher with the 10 year yield back up to 1.3% after falling as low as 1.129% earlier this week. Fears from Covid have lessened after the scare on Monday. Some GOP members have eased their criticism of the countries vaccination program as pressures mount for those unvaccinated to get vaccinated. Will they be more encouraging for vaccination for their constituency? Flash PMI numbers in Europe were mixed with Germany higher than expectations, but UK, France lower than the expected. The US Markit PMI estimates for manufacturing and services will be released at 9:45 AM ET. Canada retail sales are expected to decline by 3% when released at the bottom of the hour.

In other markets:

- Spot gold is trading down $-10.50 or -0.58% at $1796.06.

- Spot silver is down $0.27 or -1.10% at $25.17

- WTI crude oil futures are trading at $71.91 up $0.18 on the day.

- Bitcoin is trading at $32,323 up modestly on the day. The high price reached $32,915.14 the low price extended to $32,056

- Dow Jones is up up 180 points. Yesterday the index rose 25.35 points or 0.07%

- NASDAQ index is up 50 points after yesterday's 52.64 point increase

- S&P index is is up 19.7 points. Yesterday the index increase by a .79 points

- German DAX, +0.9 percent

- France's CAC, +1.0%

- UK's FTSE 100, +0.8%

- Spain's Ibex, +1.1%

- Italy's FTSE MIB, +1.1%

July 24, 2021 at 12:16AM

Greg Michalowski

https://ift.tt/3BAh4Uo

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home