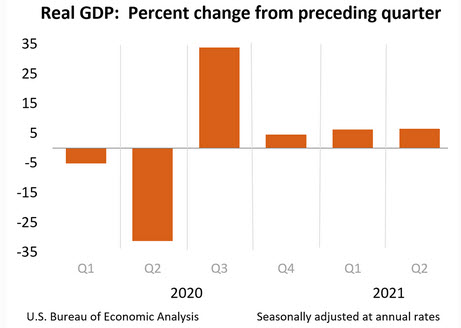

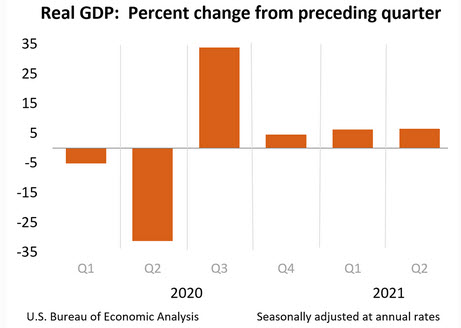

US Q2 advance GDP +6.5% vs +8.5% expected

Highlights of the first look at Q2 GDP

- Q1 was +6.4% annualized

- Personal consumption +11.8%

- GDP price index +5.7% vs +5.4% expected

- Core PCE +6.1% vs +5.9% expected

- 2020 GDP revised to -3.4% from -3.5%

- GDP final sales +7.7%

- Inventories cut 1.13 pp from GDP vs -2.67 pp in Q1

- Business investment +8.0% vs +11.7% prior

- Business investment in equipment +13.0% vs +15.0% prior

- Exports +6.0% vs -2.1% prior

- Imports +7.8% vs +9.5% prior

- Trade was a 0.44 pp drag on GDP vs -1.56 pp in Q1

- Home investment -9.8% vs +13.1% prior

- Consumer spending on durables +9.9%

- Personal consumption added 7.78 pp to GDP

- Government spending cut 0.27 pp from GDP vs +0.77 pp prior

- Full report

This is a miss but the market is taking it in stride because the inventory drags will reverse in the coming quarters and be a tailwind to growth. Companies are running lean because of supply chain bottlenecks.

Meanwhile, the performance from the consumer was solid but perhaps not as strong as the market hoped, given the potential for a reopening boom.

USD/JPY was softer on this and initial jobless claims, falling to 109.65 from 109.80 beforehand. ALl told, that's a small move.

July 30, 2021 at 12:31AM

https://ift.tt/3l8AU33

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home