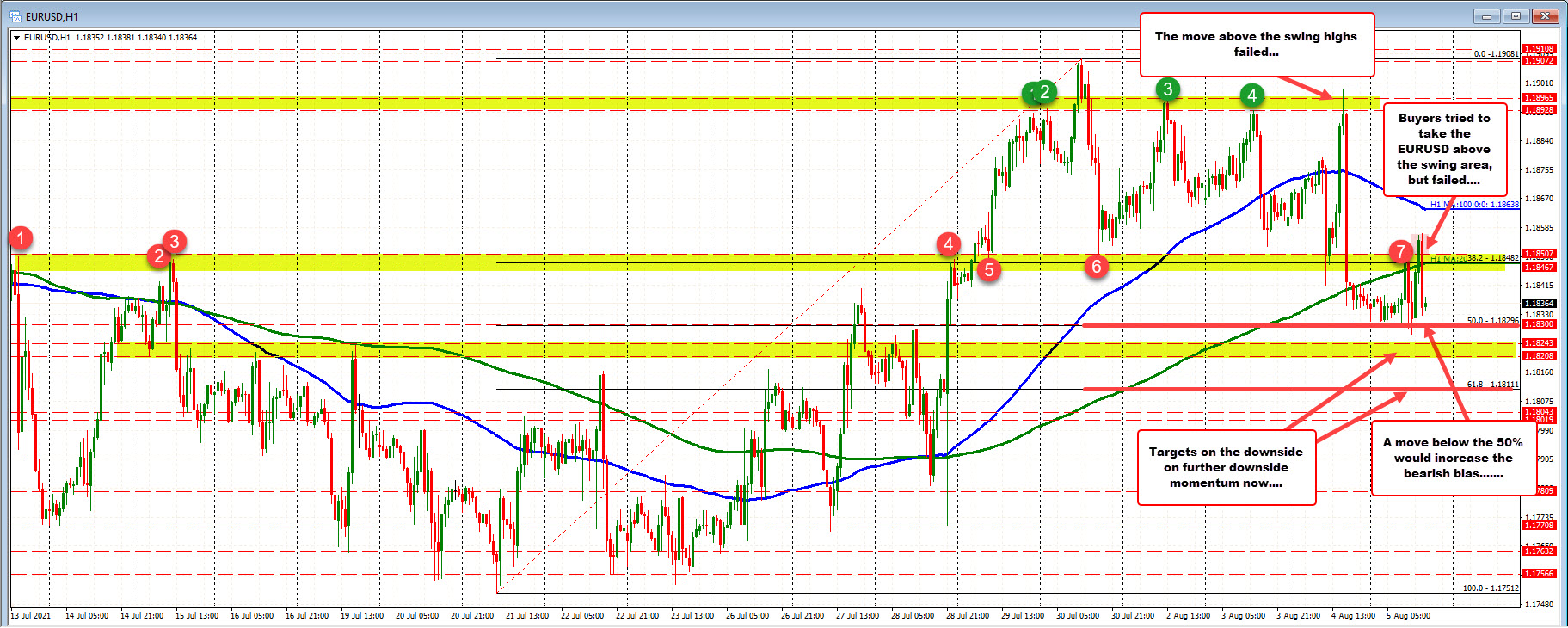

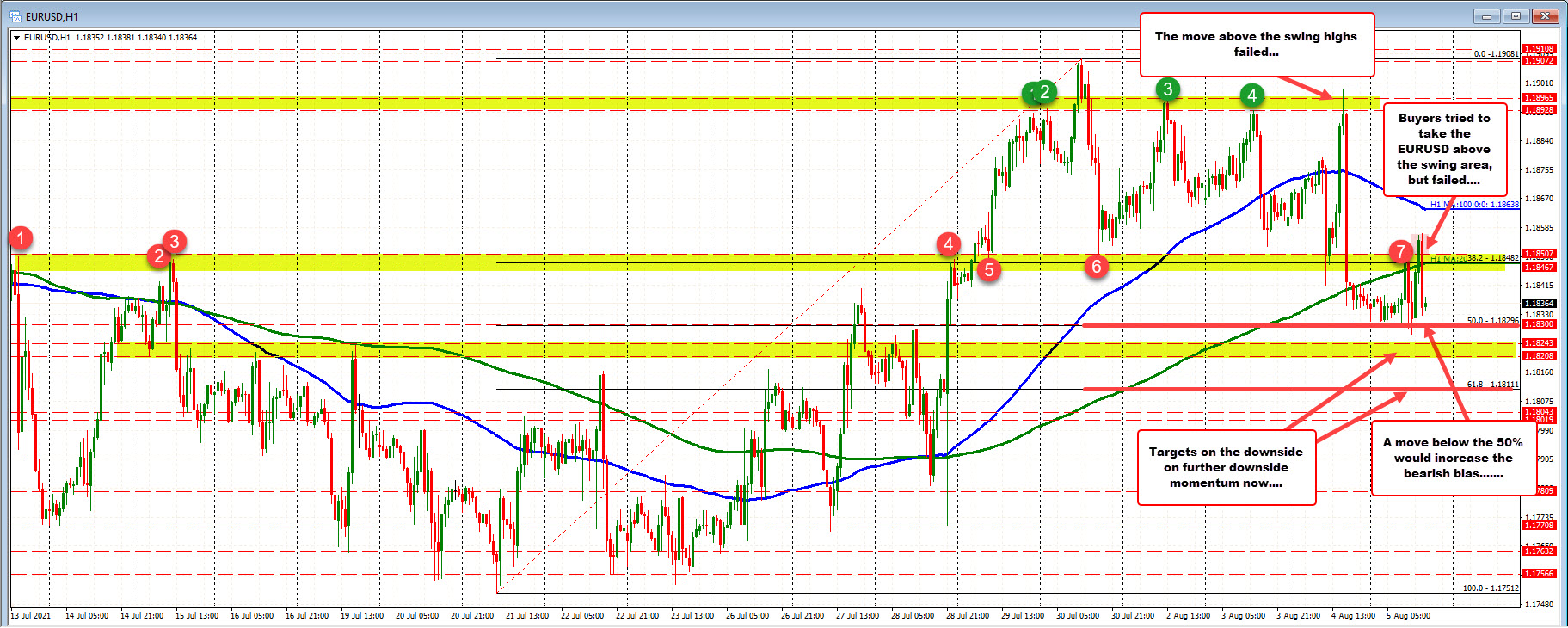

EURUSD keeps more of a bearish tilt, but choppy trading and support is holding

50% of the range since July 21 is stalling the fall today

The EURUSD has been chopping up and down especially during the European/London session.

Looking at the hourly chart, there is a swing area between 1.18467 and 1.18507. The 200 hour moving averages between that the area as is the 38.2% retracement of the move up from the July 21 low (both are at 1.18482).

The price did spike above that level in the early New York session, but quickly reversed. The pairs price is below that cluster of resistance tilting the bias more to the downside.

Having said that, the 50% midpoint of the move up from the July 21 low comes in at 1.18296. The low for the day did quickly move below that level to a low of 1.18273, but like the break higher was short lived.

So buyers have been stalling the fall near that 50% level.

If the sellers are to take more control (and keep control) they need to:

- move below the 50% retracement level and stay below

- Not move above the swing area between 1.18467 and 1.18507.

The current price trade at 1.1840.

A move back above the swing area above would have traders looking toward the 100 hour moving average 1.18638.

Conversely a move below the 50% retracement level, and traders will look to break 1.18208 on it's way to the 61.8% retracement at 1.18111.

August 06, 2021 at 01:19AM

Greg Michalowski

https://ift.tt/3ismdq5

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home