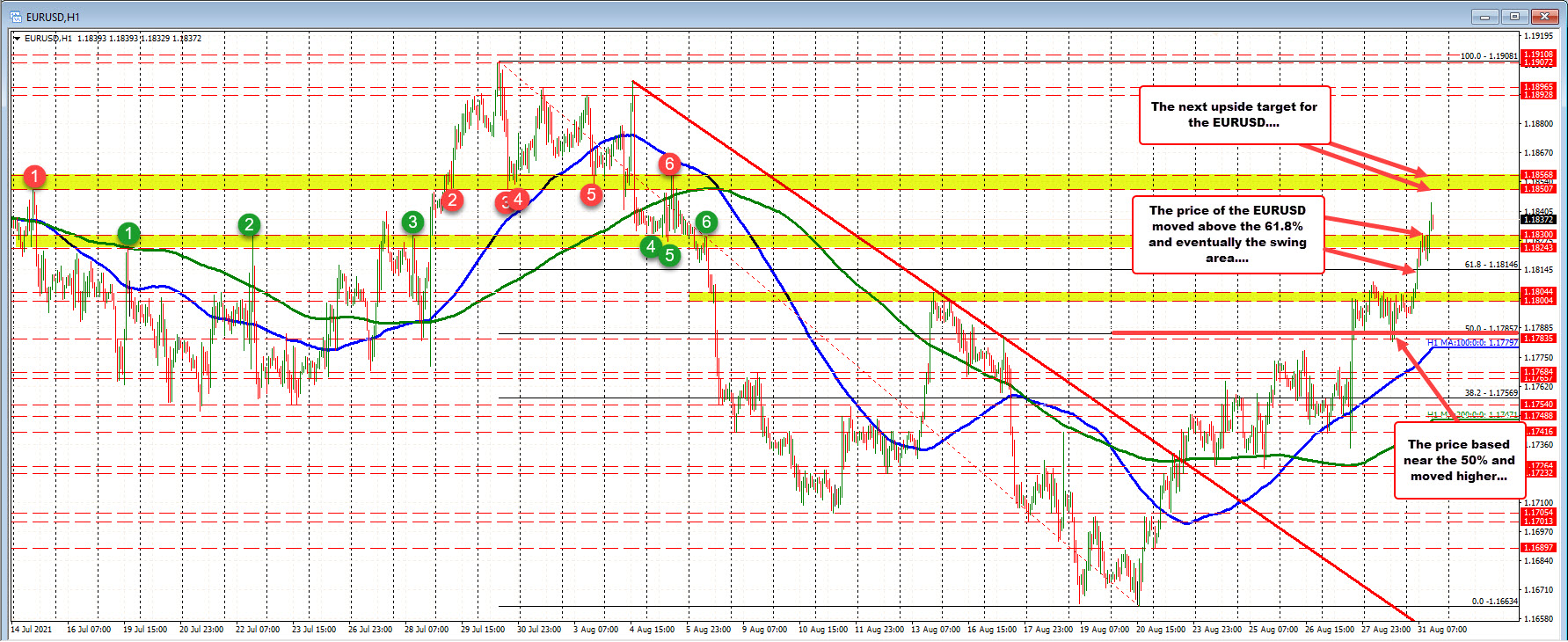

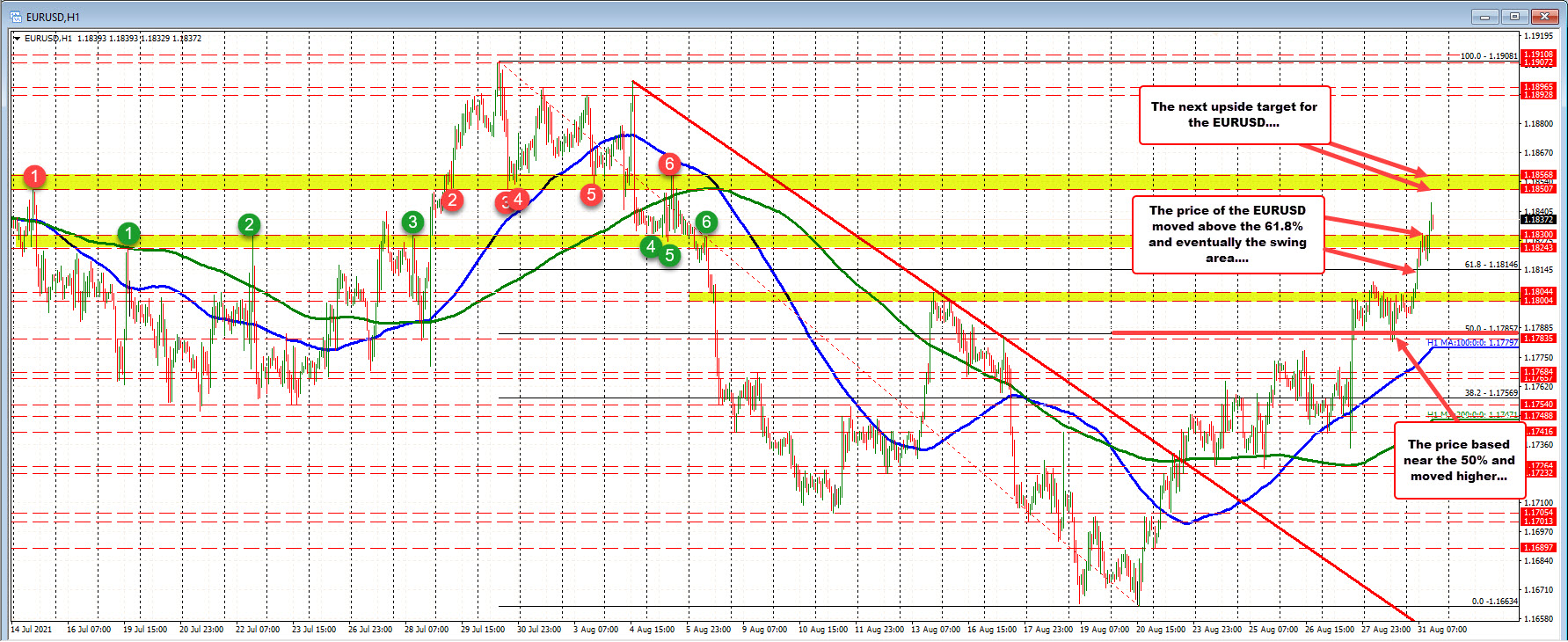

EURUSD runs higher after basing near 50% midpoint on the hourly chart yesterday

Moves away from the 1.1800 area as well

The EURUSD has made a run to the upside after basing near the 50% midpoint or the trading range since July 30 during yesterday's trade.

In the Asian session today, the price was able to break above the 1.1800 – 1.18044 area and push toward the next key target at the 61.8% retracement. Getting above that level had traders looking toward the 1.18243 to 1.1830 area (see green numbered circles). Ultimately that swing area was also broken.

We now trade just above that swing area. If the prices is to continue its trend- like move to the upside, staying above the 1.18243 to 1.18300 level will be eyed, with the next swing area at 1.18507 to 1.18568 area as the next target.

The overall price action since the swing lows on August 19 and August 20 has seen the EURUSD move up 6 of the last 7 days (today would be day seven of eight). The step from the 50% midpoint yesterday, and the move above the 61.8% retracement today is keeping the March to the upside in play. The high price for July ultimately reached above the 1.1900 level at 1.19081. The pair is still 70 or so pips away from that level, but the buyers continue to blaze an upside trail toward that area.

Watch the 61.8% retracement today for support. Stay above and the buyers remain in control.

September 01, 2021 at 12:51AM

Greg Michalowski

https://ift.tt/38pRmVl

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home