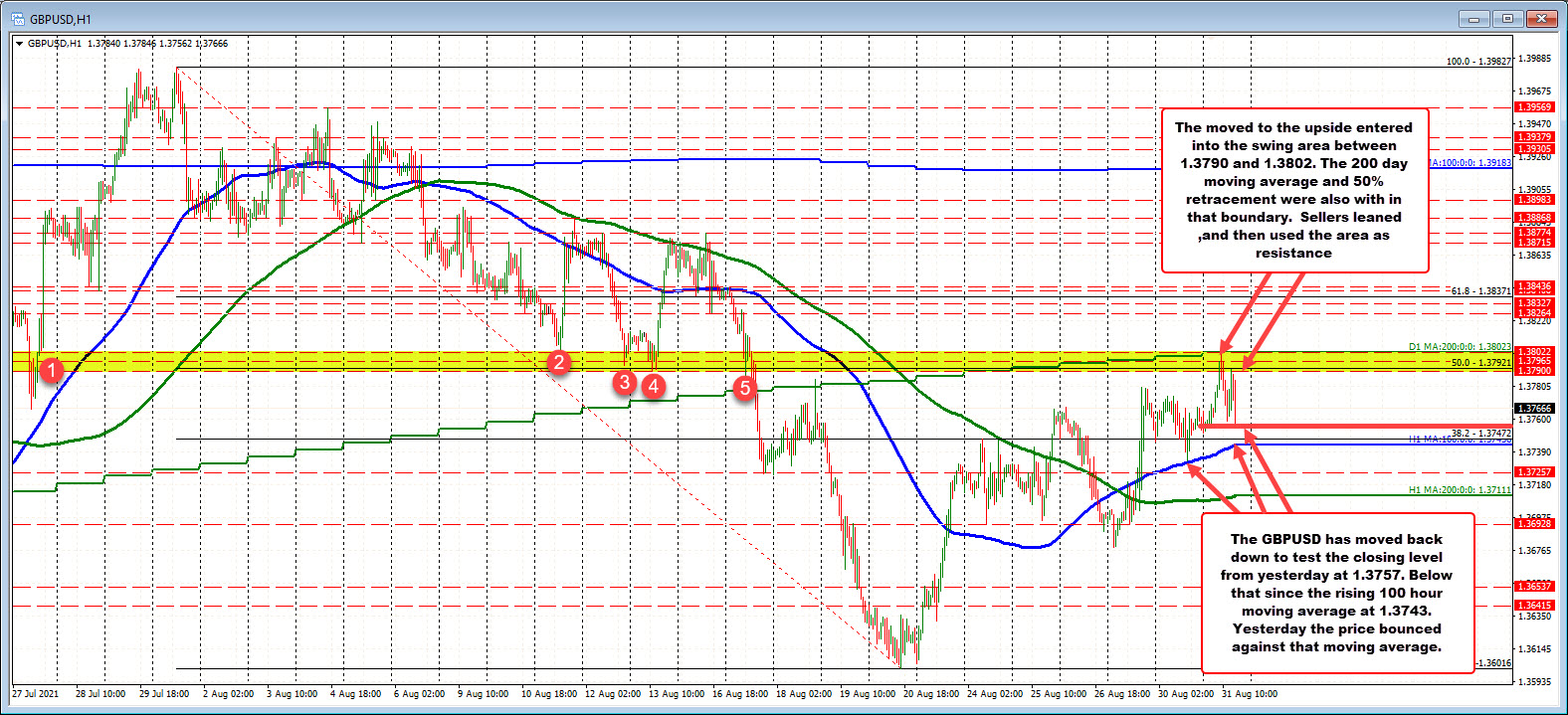

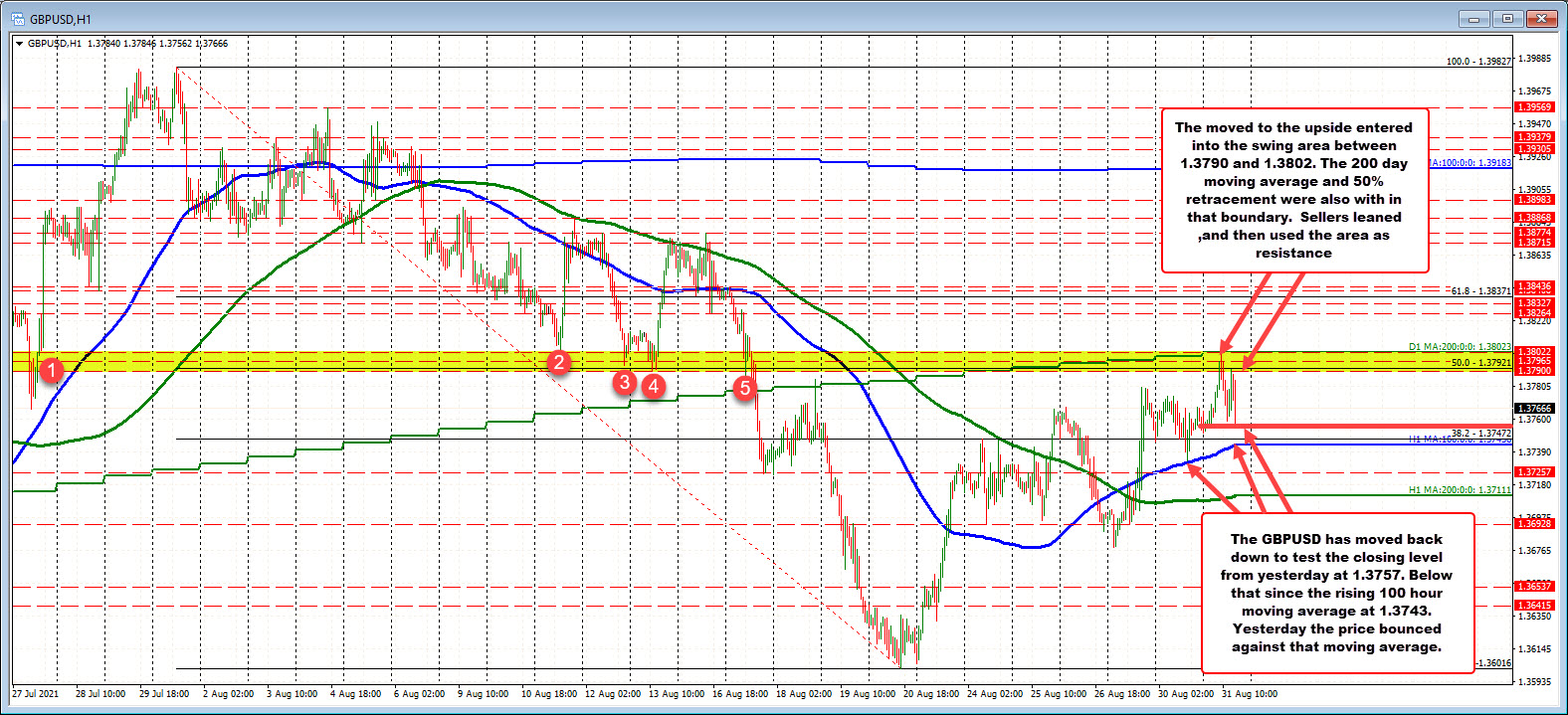

GBPUSD moves back toward close from yesterday after run to the 200 day MA found sellers

Sellers leaned ahead of the 200 day moving average

The GBPUSD moved higher in the Asian session and reached up to test a key swing area between 1.3790 and 1.38022.

Within that area sits the 50% midpoint of the range since the July 30 high at 1.37921, and the key 200 day moving average a little higher at 1.38023.

The high price reached 1.38007 - just below the 200 day moving average level. Sellers were waiting against the level as risk could be defined and limited. The price moved lower and the swing area solidified itself as resistance.

The price has since moved back down toward the close from yesterday. The close from yesterday was 1.3757. The low price just reached 1.3756 and bounced. The current price is trading at 1.3770. Buyers are trying to keep the price in the black.

Should the price move into negative territory, the rising 100 hour moving average comes in at 1.3743. Recall from yesterday, the low price in the early North American session did find buyers against that level. Getting below the 100 hour moving average would increase the bearish bias.

September 01, 2021 at 01:35AM

https://ift.tt/3zxDnIV

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home