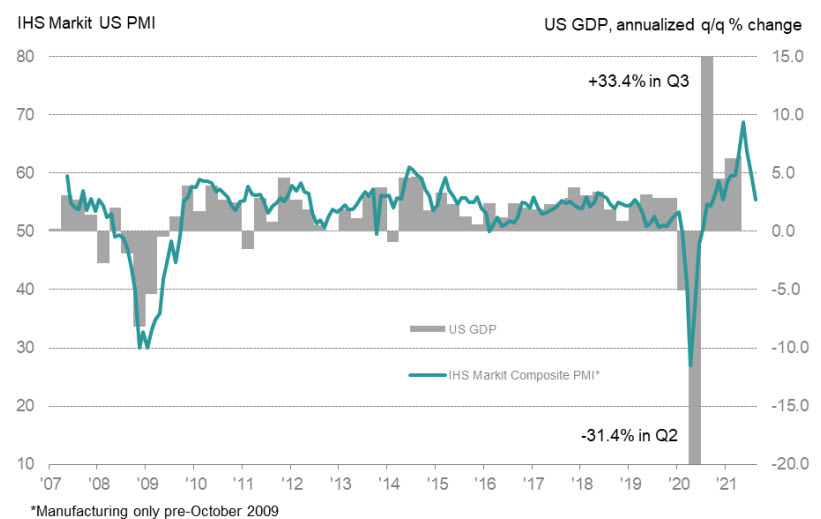

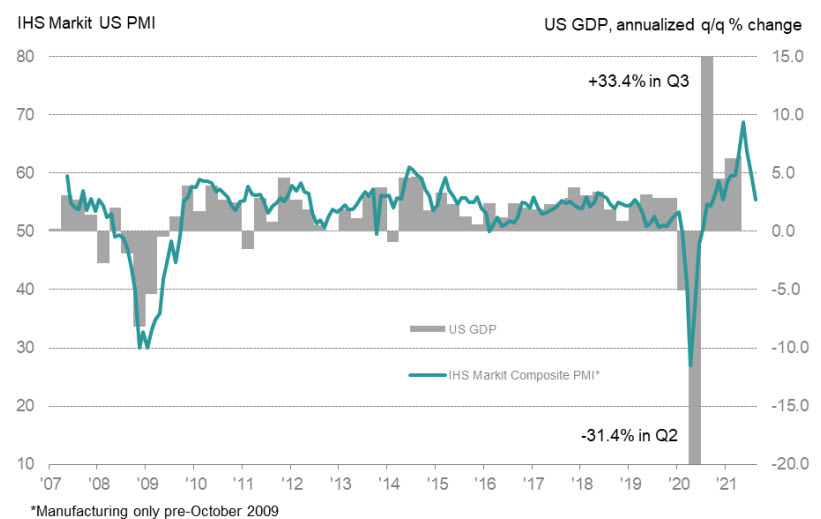

Markit August prelim US services PMI 55.2 vs 59.5 expected

The Markit preliminary services and manufacturing surveys

- Prior was 59.9

- Manufacturing 61.2 vs 62.5 expected

- Prior manufacturing was 63.4

- Composite index 55.4 vs 58.3 prior -- lowest since Dec

- Prior composite 59.9

Details on inflation:

- Services input prices 73.5 vs 72.3 prior

- Manufacturing input prices 88.4 vs 86.7 prior

- Composite input prices 75.9 vs 74.6 prior

The upward trend continues in pricing pressure.

Overall, this is the third month of declining momentum but the survey is still well-above 50, which denotes expansion.

"Not only have supply chain delays hit a new survey record high, but the AUgust survey saw increasing frustrations in relation to hiring," said survey economist Chris Williamson. "Jobs growth waned to the lowest since July of last year as companies either failed to find suitable staff or existing workers switched jobs."

There was a wobble in sentiment on the release but it was quickly erased. I tend to think that bad news is good news ahead of Jackson Hole as the market bets on Powell staying dovish rather than hinting at a Sept taper.

August 24, 2021 at 01:45AM

https://ift.tt/3DanBWB

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home