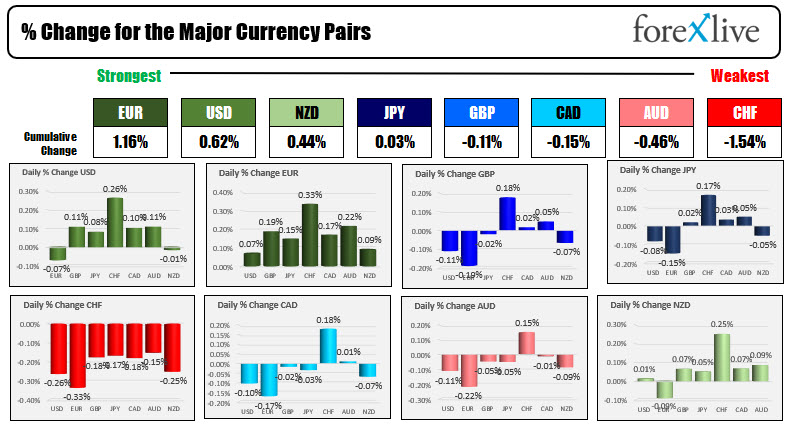

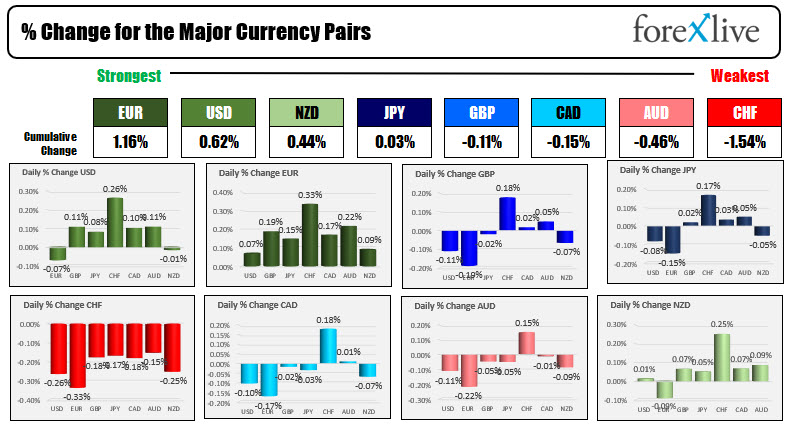

The EUR is the strongest and the CHF is the weakest as the NA session begins

The EUR is the strongest and the CHF is the weakest as the NA session begins

The USD mostly higher but only modestly

As the North American session begins, the snapshot of the strongest weakest shows the EUR it is strongest and the CHF is the weakest. The USD it is mostly higher but only modestly. US first revision to the GBP will be released at the bottom of the hour with the expectations for growth to come in a little bit stronger than expected at 6.7% versus 6.5%. The GDP price index is part of that report with that expected to remain unchanged at 6.0% . Also initial jobless claims are expected at 345 versus 348 last week. Feds Esther George is looking for a taper this year. Feds Bullard speaks on CNBC shortly (he is a hawk).

Looking at other markets

- the Spot gold is trading down mine is $2.20 or -0.13% $1787.91

- spot silver is down $0.17 -0.78% at $23.64

- WTI crude oil futures are down $0.71 or -1.01% at $67.65

- Bitcoin is down $2500 at $46,510

The US stock market the major indices are mixed with the Dow higher and the Nasdaq lower. The futures are currently implying:

- Dow of 52.5 points

- S&P index is down -0.69 points. It closed at a record high for the 51st time yesterday

- Nasdaq is down 22.92 points. It too closed at a record yesterday which was the 30th record high

in Europe, the major indices are trading lower:

- German DAX -0.5%

- France's CAC -0.3%

- UK's FTSE 100 -0.3%

- Spain's ibex -0.5%

- Italy's FTSE MIB -0.4%

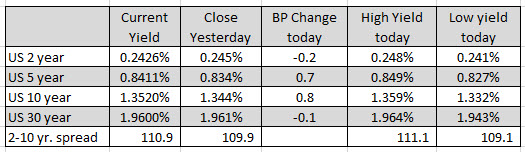

in the US debt market, the yields are modestly changed:

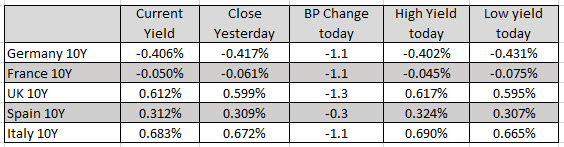

In the European debt market, the benchmark 10 year yields are trading lower across the board but only by about a basis point or so.

Invest in yourself. See our forex education hub.

August 27, 2021 at 12:09AM

https://ift.tt/3jiTJPR

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home