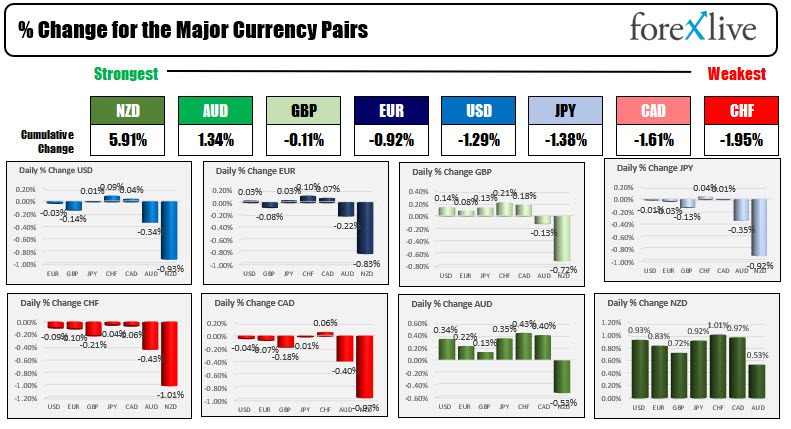

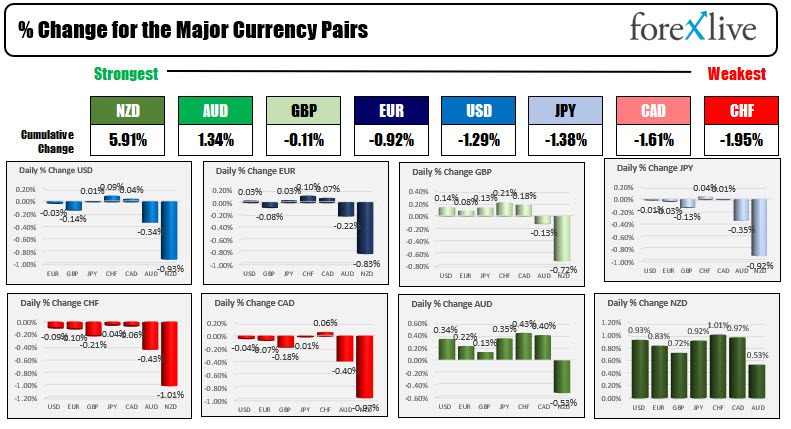

The NZD is the strongest and the CHF is the weakest as NA traders enter for the day

The NZD is the strongest and the CHF is the weakest as NA traders enter for the day

The USD is lower with most of the activity vs the NZD and AUD

The NZD is the strongest and the CHF is the weakest as the North American session begins. In New Zealand their quarterly employment report showed the Unemployment rate tumbling to 4% vs 4.5% estimate and the employed numbers showed a 1% gain vs 0.7% estimate. THe stronger numbers now have ANZ, ASB, BNZ, Westpac, and KiwiBank forecasting rate hikes starting in August. The next meeting is set for August 18. The move dragged the AUD higher with it. The USD is little changed vs the EUR, GBP, JPY, CHF, and CAD - and sharply lower vs the AUD and NZD - as traders brace for the ADP National Employment report which will be released at 8:15 AM. The estimate is for a 695K gain vs 692K last month. The ADP number has not been the best at forecasting the BLS's jobs report (last month the BLS reported 850K. On Friday, the estimate is 870K), however, that will not stop the market from reacting today. Be aware. The other key event today will be the Markit Services PMI at 9:45 AM ET, and the ISM services PMI at 10 AM ET (est 60.5 vs 60.1 last). Also at 10 AM will be FOMC Vice Chair Clarida speaking. The market is beginning to line up the names of the hawks with Bullard, Kaplan and Waller leaning on the "let's get tapering side" . Clarida has been more siding with the chair, but we will see today, how he lines up now.

Looking at other marketss:

Looking at other marketss:

- Spot gold is trading up $8.88 or 0.49% $1819.34

- Spot Silver is up $0.29 or 1.11% at $0.5 and $0.80

- WTI crude oil futures are $-0.78 or -1.12% $69.42

- Bitcoin is trading at $38,274. It has moved lower after SEC chair Gary Gensler said that he would like increased authority from Congress to tackle rampant fraud, scams and abuse in the crypto markets.

- Dow -90 points

- S&P -9 points

- NASDAQ index -16 points

In the European equity markets, the major indices are mostly higher:

- German DAX +0.6%

- France's CAC, +0.3%

- UK's FTSE 100, +0.3%

- Spain's Ibex, -0.2%

- Italy, +0.26

Invest in yourself. See our forex education hub.

August 05, 2021 at 12:06AM

https://ift.tt/3jqlMMb

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home