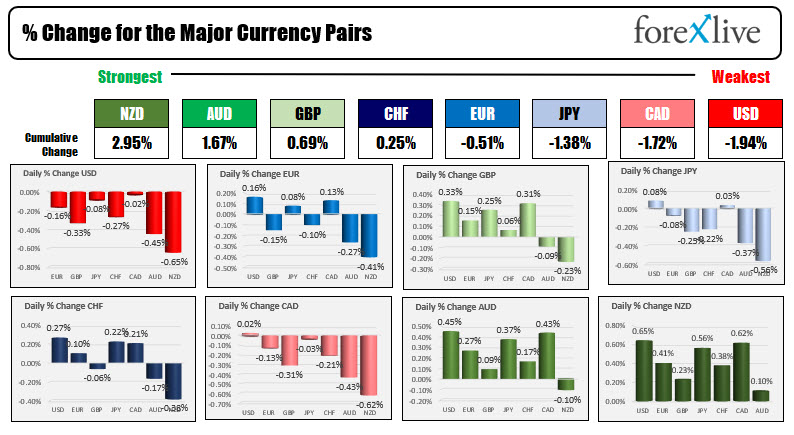

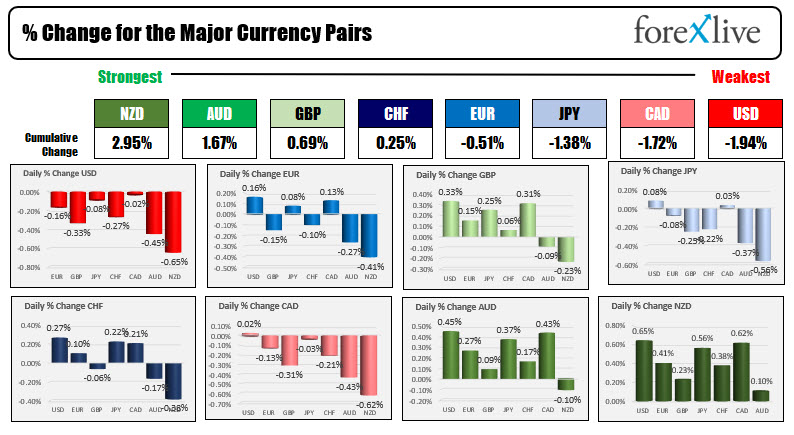

The NZD is the strongest and the USD is the weakest as NA traders enter for the day.

The RBA keeps rates unchanged and does not change QE plans

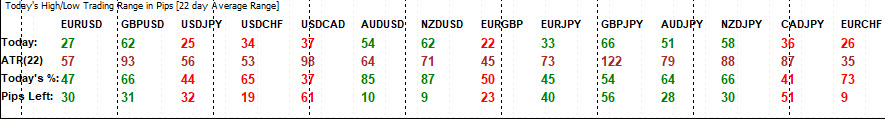

The snapshot of the morning session shows some rather modest trading ranges in some of the major currency pairs. The EURUSD has only a low to high trading range of 27 pips (vs 57 pip average over the last month of trading). The USDJPY has a range of 25 pips (vs 56 avg), the USDCAD 37 pips (vs 98 pip avg) and USDCHF (34 pips (vs 53 pip avg.).

In other markets:

- Spot gold is down around four dollars or -0.23% at $1808.80.

- Spot silver is up three cents or 0.08% $25.38

- WTI crude oil futures are trading down $0.86 or -1.2% at $70.74 after yesterday's sharp declines of over 3%

- Bitcoin is trading at $38,353 that's down around $800 on the day. The weekend high reached $42,400.

The premarket for US stocks shows the major indices are higher after the mixed results yesterday (the NASDAQ held onto small gains)

- S&P index is up 14.09 points. The S&P index fell -8.11 points yesterday

- Dow industrial average is up 135.84 points. The Dow felt -97.11 points yesterday

- NASDAQ index is up 24.38 points. The NASDAQ index rose 8.39 points.

In the European markets, the major indices are trading higher:

- German DAX +0.23%

- France's CAC +1%

- UK's FTSE 100 +0.5%

- Spain's Ibex +0.7%

- Italy's FTSE MIB +0.5%

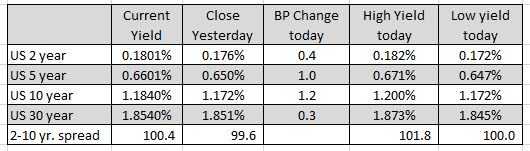

In the US debt market, yields are starting the New York session a little bit higher from yesterday's closing level. The benchmark 10 year yield is up to 1.184%, up 1.2 basis point on the day.

On the economic calendar today:

On the economic calendar today:- US factory goods orders for June along with the revision to durable goods orders will be released at 10 AM ET. Factory orders are expected to rise by 1.0% after a 1.7% increase in May. The preliminary June durable goods orders was released on July 27 and showed a 0.8% gain versus 2.1% expected. The ex-transportation came in at 0.3% versus 0.8% expected. Capital goods orders nondefense ex air (piece used in US GDP calculations) rose 0.5% versus 0.7% expected. The report was the fourth Miss in a row, but revisions to the prior month were higher

- Fed Bowman (Voter) is speaking at a conference on "Toward an inclusive recovery: Improving labor force attachment and financial security among low income and marginalize workers" He is scheduled to speak at 2 PM ET

August 04, 2021 at 12:23AM

Greg Michalowski

https://ift.tt/3ylOzYB

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home