USDJPY remains above its converged 100 and 200 hour moving averages

Weaker US nonfarm payroll does not push the price back below the 100/200 hour MAs

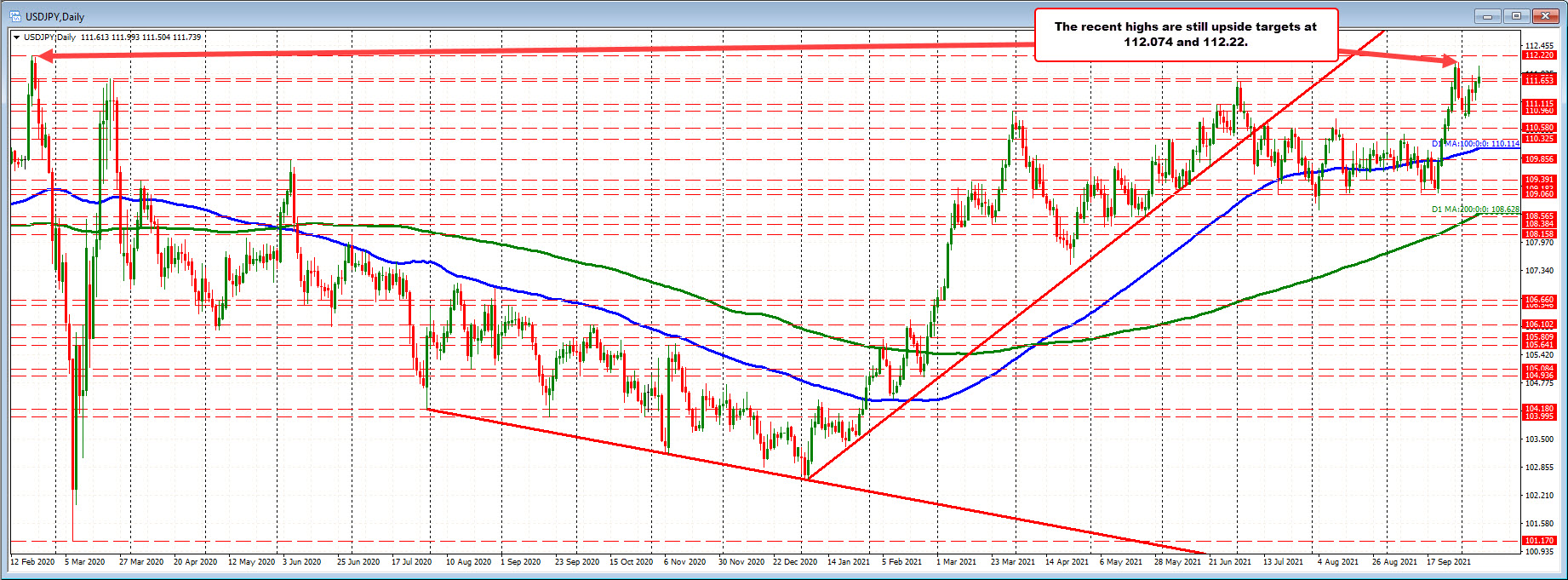

The USDJPY moved lower after the US jobs report, but could not approach or test the 100 and 200 hour moving averages which are near converged at 111.42. The low price reached 111.504.

Yes, a new low was made, but the buyers aren't exactly running for the exits. The sellers cannot push below the moving averages, nor the rising trendline on the hourly chart above which cuts across right at the moving average levels as well.

So that 111.42 level remains a key technical and bias defining level. Stay above and the buyers are still in play (have more control). Move below and the bias shifts in the favor of the sellers.

Having said that on the topside, the high price today also stalled ahead of the recent cycle high from September 30 at 112.074. That was the highest level going back to February 21, 2020 (see daily chart below) when the price peaked at 112.22. Both those levels remain key upside targets on further momentum. The high price today reached 111.949 before rotating back to the downside pre-jobs report.

Buyers need to extend above those levels to increase their control now.

October 09, 2021 at 01:29AM

Greg Michalowski

https://ift.tt/3Fpv59r

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home