Eyes on housing inflation in the US CPI report

The housing component is getting more attention

US CPI is expected to rise 5.3% in today's report, a slight dip from 5.4% in September. The core numbers are expected steady at 4.0%.

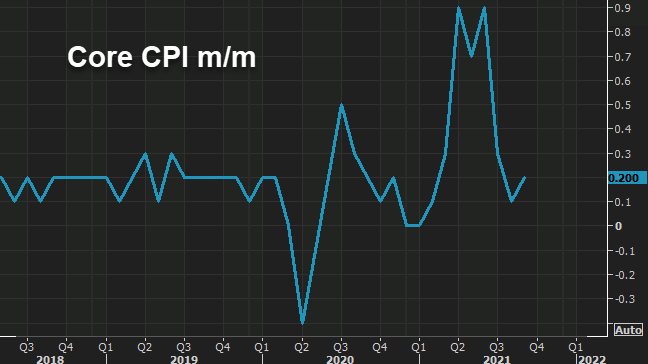

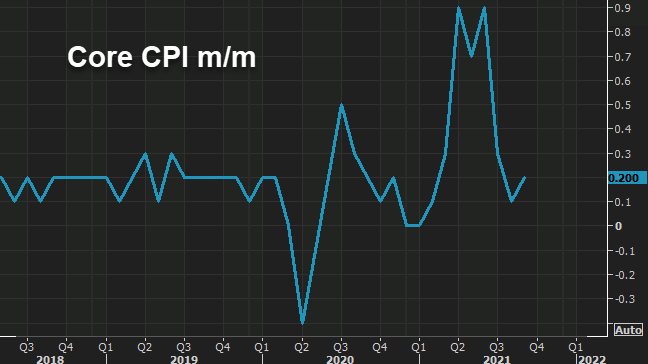

Watch the core month-over-month CPI number, which is forecast to rise 0.4% from 0.2% in Sept. That metric has been moderating in a transitory signal but a pickup would be a red flag.

The inflationary argument for 2022 and beyond is that housing and rent inflation will keep overall prices elevated. I think international experiences give us ample evidence that's unlikely to be the case but it's a market focus.

Credit Suisse said a housing inflation number above 0.5% "raises the odds that inflation will not be transitory but rather persistent."

"Given the recent retracement lower in US terminal rate expectations (for example the 5y1y rate), any reversal higher for that variable on this outcome would likely help the USD, especially if it also leads, finally, to real rates also moving up. Still, that latter element would require the rise in nominal yields to outpace the rise in inflation breakevens, which recent history suggests is anything but a given."

November 11, 2021 at 01:12AM

Adam Button

https://ift.tt/2YyhHiB

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home