Nordea sees EUR/USD dropping to 1.08 by the end of next year

Nordea sees EUR/USD dropping to 1.08 by the end of next year

Forex 2 hours ago (Nov 10, 2021 05:40AM ET)

Forex 2 hours ago (Nov 10, 2021 05:40AM ET)

Nordea Forecasts 2/2

Nordea Forecasts 2/2

By Samuel Indyk

Investing.com – Analysts at Nordea Bank expect a more aggressive Fed tightening cycle over the next two years than is currently priced in and therefore say the USD is likely to outperform its peers.

In a research note, analysts Andreas Steno Larsen and Jan von Gerich, said that they expect six interest rate hikes from the Federal Reserve through 2023, three hikes next year and three in 2023.

Reasoning

“We continue to find that the Fed is too confident in the transitory narrative, even if they have moved consistently in the direction of our views since the beginning of this year,” Larsen and von Gerich said.

However, they cautioned that the forecast of three rate hikes next year (June, September, and December) would be under pressure should the Fed decide not to increase the tapering pace in Q1. Larsen and von Gerich think an increase in the monthly tapering pace of $20 billion per month, rather than the current planned $15 billion per month, is “on the cards” in the first quarter.

At the current speed, tapering of asset purchases will conclude by the middle of June.

Nordea expects core inflation to increase to over 5% by the end of the year, with headline inflation exceeding 6%. The analysts believe that the Fed will start to get increasing evidence of a broader price pick-up which supports their view of a faster taper and three hikes next year.

ECB to hike?

Larsen and von Gerich do not expect ECB rate hikes to be on the table next year, with the central bank adamant that high inflation in the Eurozone is transitory and will fall back below target next year.

The two analysts “largely agree” with that assessment but do see inflation pressure mounting gradually in the Euro area as the labour market recovery proceeds.

Therefore, Nordea has now added one 25 basis point hike to their baseline forecast for late 2023.

USD to outshine peers

With the Fed on a more aggressive tightening cycle, Larsen and von Gerich stick to their long-held view that the relative discrepancy policy-wise should lead to a stronger USD versus EUR.

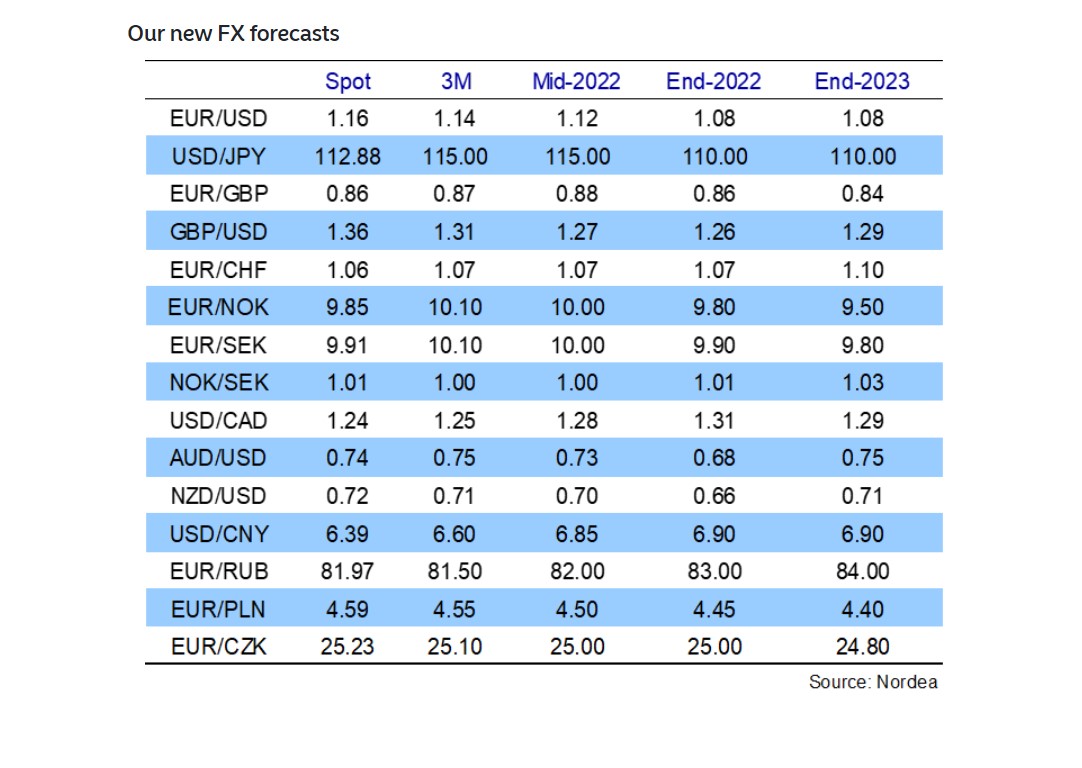

Nordea now sees EUR/USD falling to 1.08 by the end of next year, with next year’s French election and fraught relations between the EU and UK also potentially playing a part in EUR weakness.

However, they note that rumours that the UK may decide to trigger Article 16 and lead to a renegotiation of the Brexit trade deal as being a “clear risk” for GBP.

Therefore, despite the Bank of England being on a more hawkish path than the ECB, Nordea sees EUR/GBP increasing to 0.88 by the middle of next year and GBP/USD dropping as low as 1.2700.

In regards to government bond yields, Nordea has lifted its forecast for the US 10-Year yield and now expects it to hit 2.5% by the end of next year (previously 2.30%).

Nordea has also lifted its forecast for the German 10-Year yield to 0.25% at the end of next year from 0.10% previously.

Related Articles

Column: Hedge funds' FX plays get crushed in red October By Reuters - Nov 10, 2021

Column: Hedge funds' FX plays get crushed in red October By Reuters - Nov 10, 2021

By Jamie McGeever ORLANDO, Fla. (Reuters) - The recent explosion in interest rate volatility and dramatic repricing of central banks' near-term policy path has claimed a few...

Dollar ticks up ahead of U.S. inflation test By Reuters - Nov 10, 2021

Dollar ticks up ahead of U.S. inflation test By Reuters - Nov 10, 2021

By Julien Ponthus LONDON (Reuters) - The dollar nudged up against major peers on Wednesday after weakening in the past three days with investors taking little risk ahead of U.S....

Dollar Pushes Higher; U.S. CPI Release in Focus By Investing.com - Nov 10, 2021

Dollar Pushes Higher; U.S. CPI Release in Focus By Investing.com - Nov 10, 2021

By Peter Nurse Investing.com - The dollar edged higher in early European trade Wednesday, with producer price inflation data in both the U.S. and China weighing on risk sentiment,...

Fusion Media or anyone involved with Fusion Media will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading the financial markets, it is one of the riskiest investment forms possible.

November 10, 2021 at 10:40PM

Investing.com

https://ift.tt/3HbTvDW

Labels: Forex News Investing.Com Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home