GBPUSD stays below resistance swing area today

Price for the week reached the lowest level since December 2020 today

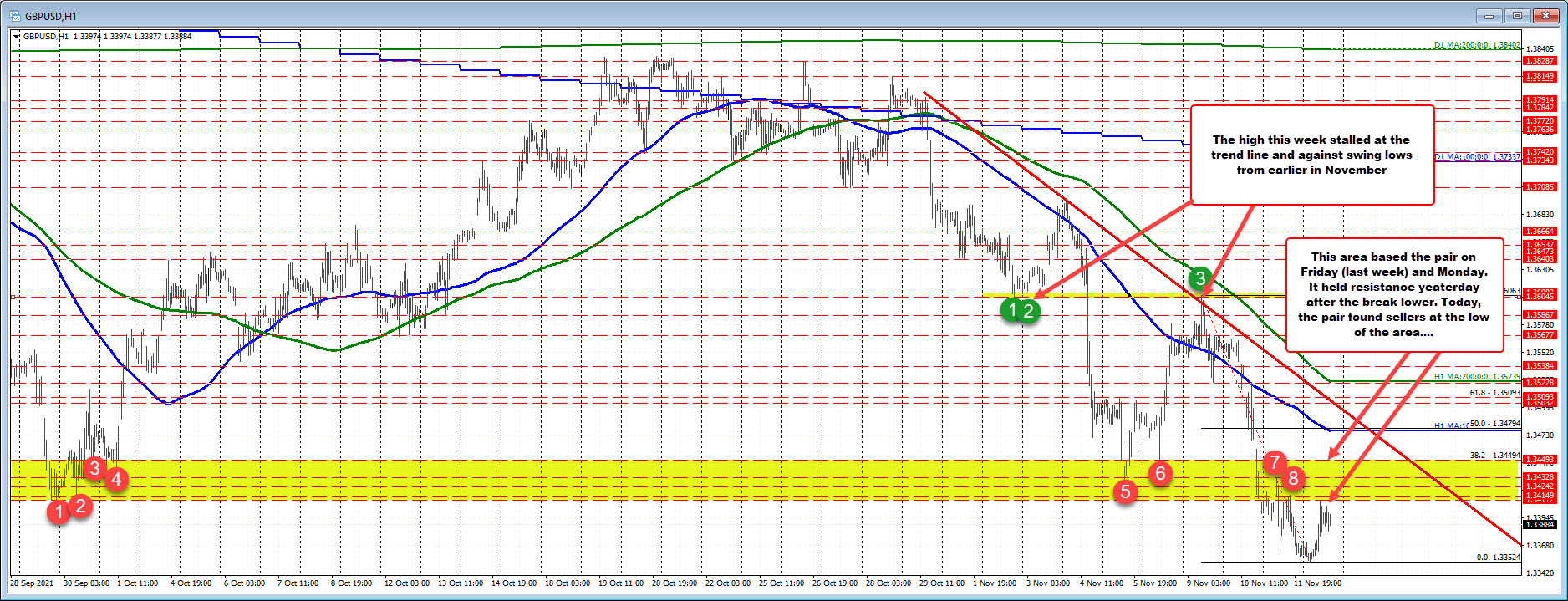

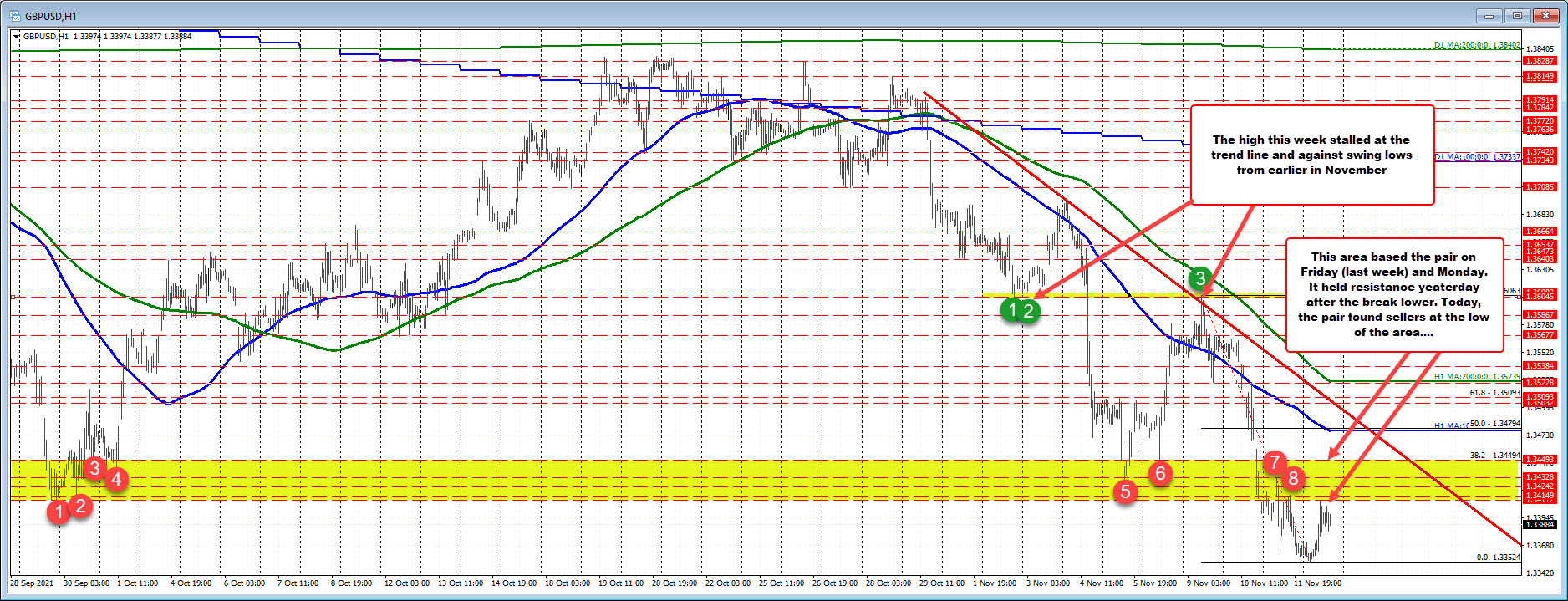

The GBPSUD moved up on Monday and Tuesday. At the highs on Tuesday, the price tested swing lows from November 2 and November 3 and also a downward sloping trendline. Sellers leaned against the level and pushed lower into the close (on Tuesday).

On Wednesday, the US CPI helped to push the pair sharply to the downside, and in the process started to breach a swing area between 1.3411 and 1.34493 (going back to the end of September). The 1.3411 was the low for the year going back to September 29.

On Thursday up and down trading took the price within the swing area, but below the high borderline at 1.34494. The price closed near the low (PS.

In trading today, a new 2021 low was reached at 1.33524, but found profit-taking buyers. Those buyers have 1.34104. That is just below the old 2021 low going back to September 29 near 1.3411. Sellers are leaning against the old low and in doing so, keeping the bears in full control.

Going forward, it would take a move back above the 1.3411 level and then the 1.3449 level to give buyers some comfort. Above that traders would be targeting the 100 hour moving average of 50% retracement of the move down from this week at 1.3479 area (the 100 hour moving average is moving lower).

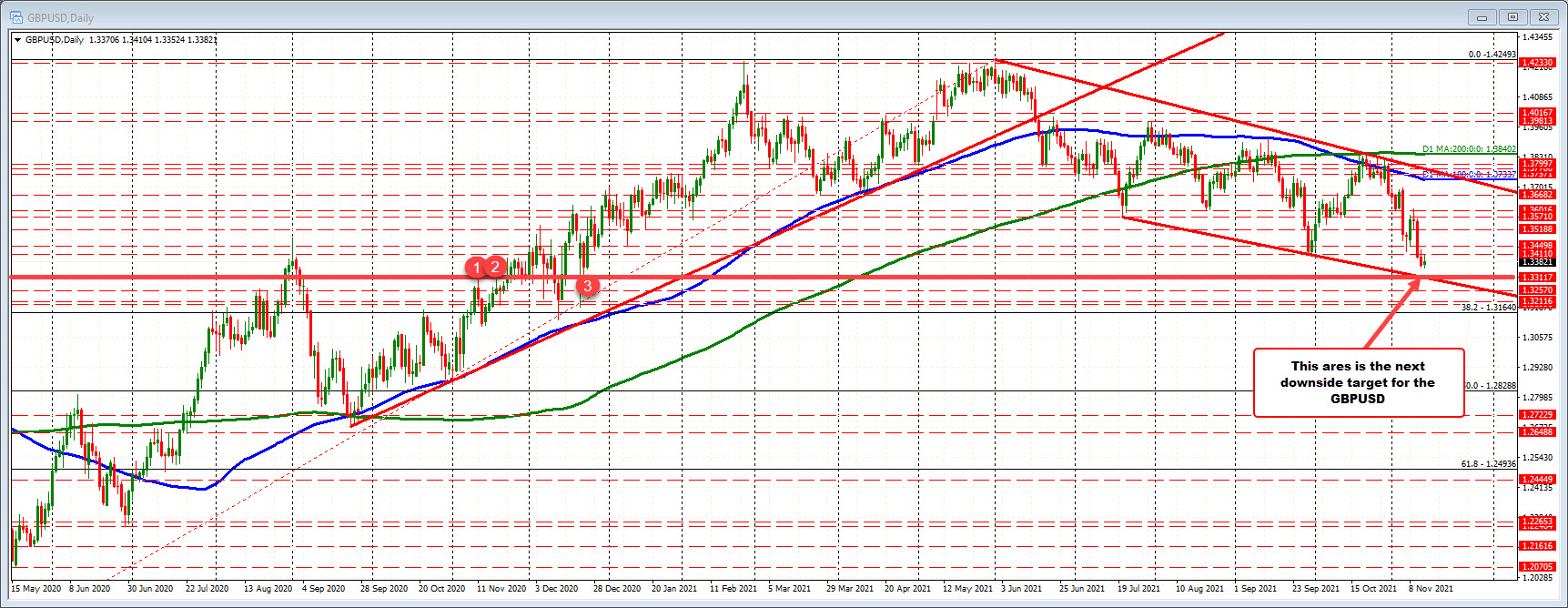

Looking at the daily chart, on the downside, the 1.3312 level is home to the lower trendline and some swing levels going back to November (see red numbered circles). If the buyers cannot take control, moving down toward that area is not out of the question going forward.

PS the 38.2% retracement of the move up from the March 2020 low comes in at 1.3164. It's still quite a ways away, but if dollar buying into the year and continues, that would be a major target area.

November 13, 2021 at 02:36AM

Greg Michalowski

https://ift.tt/3c8vM9s

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home