Manufacturing and another Treasury auction on the US agenda

What's coming up today

The global co-ordinated oil reserve release today is dominating the headlines at the moment but certainly not spooking the oil market. WTI is down 25-cents to $76.50.

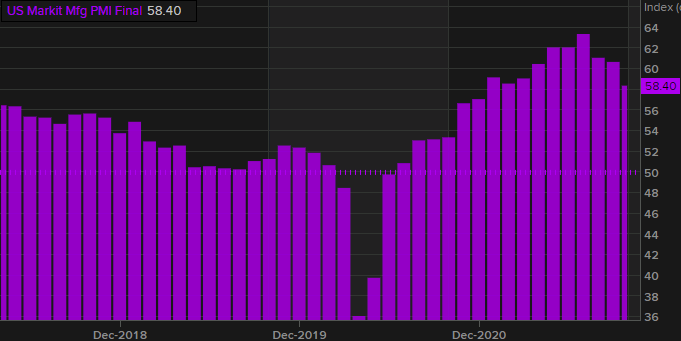

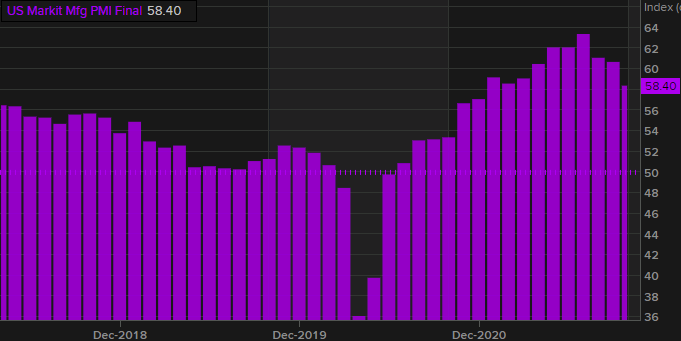

The real economy will come back into focus in the hours ahead, and particularly manufacturing as we speed towards the US Thanksgiving holiday. Up first is at 9:45 am ET (1445 GMT) with the Markit manufacturing PMI for November. The consensus is 59.0 from 58.4. With that is the services PMI, which is forecast at 59.1 from 58.7 prior.

Fifteen minutes later is the Richmond Fed, which is forecast to dip to +5 from +12.

The bond market continues to digest the Powell re-nomination with yields grinding around 2 bps higher across the curve. That will be tested at 1 pm ET with a US 7-year Treasury sale.

On the international calendar, we hear from the BOC's Beaudry (1 pm ET) and ECB's De Guindos (1:40 pm ET).

November 24, 2021 at 01:33AM

Adam Button

https://ift.tt/30OH8x2

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home