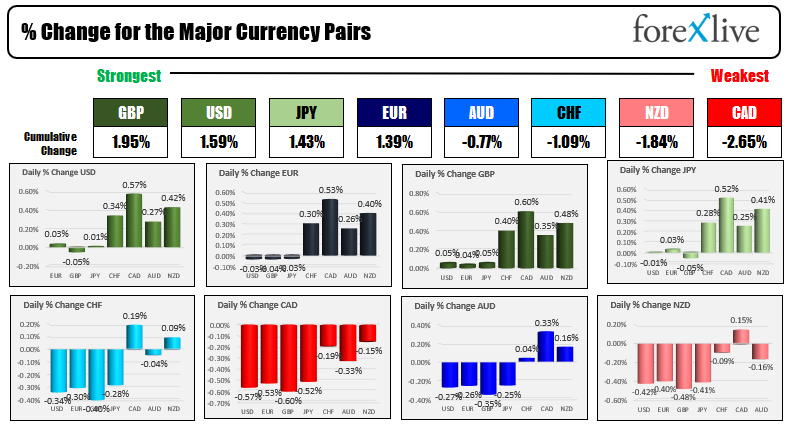

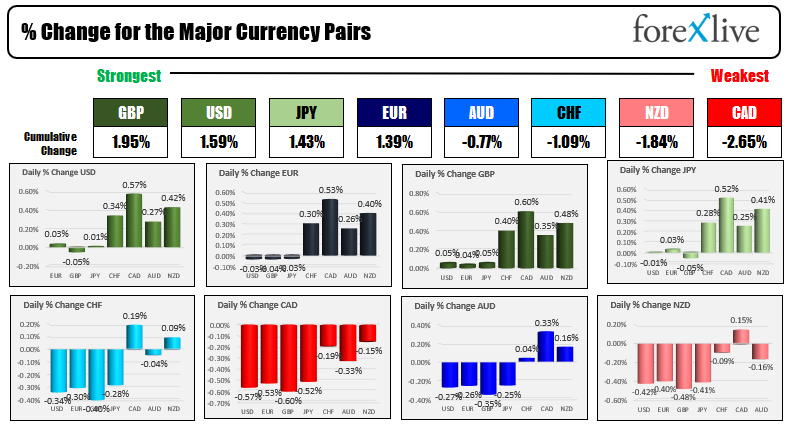

The GBP is the strongest and the CAD is the weakest as NA trading begins

The USD is stronger continuing its run to the upside after US CPI data.

As North American traders enter for the day, the GBP is the strongest and the CAD is the weakest. The USD is mostly higher after the surge yesterday after the US CPI data reached a 30 year high. US stocks are trading higher in premarket trading after yesterday's sharp fall which saw the NASDAQ index shed -1.66% and the S&P index fall -0.82%. The US bond market is closed in observance of Veterans Day after yesterday's sharp move higher in yields which saw double-digit gains across the maturity spectrum. The two year yield was up 11.2 basis points at 0.5209% all, the five year yield is up 15.9 basis points at 1.227% and the 10 year yield is up 12.4 basis points at 1.573%. The poorly received 30 year auction (along with the higher CPI) caused the consternation in the debt markets. The 30 year yield ended up about 11 basis points at 1.927%. Although yields were sharply higher, the 10 year yield still remains below its October high of 1.706% (but is up from 1.45% on November 9). Canada is off today in observance of Remembrance Day. The US bond market is closed and observance of Veterans Day, but US stock markets are open. As a result, there are no major economic releases today.

In other markets, a snapshot shows:

- Spot gold is trading up $9.57 or 0.52% at $1858.50. Yesterday the price rose $18.

- Spot silver is up $0.28 or 1.15% $24.89 after yesterday's increase of $0.36

- WTI crude oil futures are down $0.63 or -0.74% at $80.71. The price started to fall sharply after the sharp dollar rise yesterday. The high yesterday reached $84.97 while the contract closed down nearly 3 dollars and $81.19.

- Bitcoin is trading near unchanged at $64,778 after moving to a new all-time record high yesterday of $69,000

The US debt market is closed today in observance of Veterans Day. Although the bond market is close, the US equity markets are open.

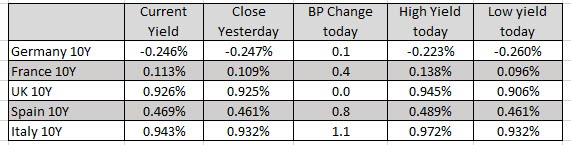

In the European debt market, the benchmark 10 year yields are marginally higher yields trading above and below unchanged in trading today:

In the premarket for US stocks, the futures are implying a higher opening after yesterday's sharp declines:

- Dow industrial average +63 points. The index fell -240.04 points yesterday

- S&P index +18.6 points after yesterday's -38.56 point decline

- NASDAQ index +104 points after yesterday's -263.84 point slide

The European equity markets, the major indices are trading mixed:

- German DAX, unchanged

- France's CAC, unchanged

- UK's FTSE 100, +0.4%

- Spain's Ibex, -0.6%

- Italy's FTSE MIB -0.1%

November 12, 2021 at 12:46AM

https://ift.tt/3krkmCp

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home