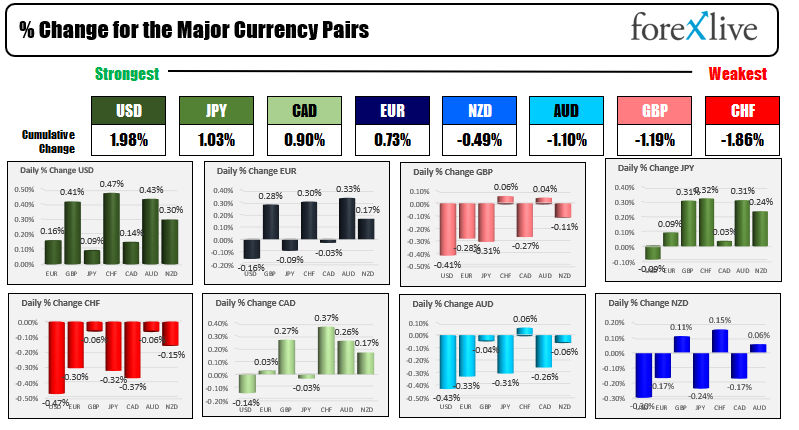

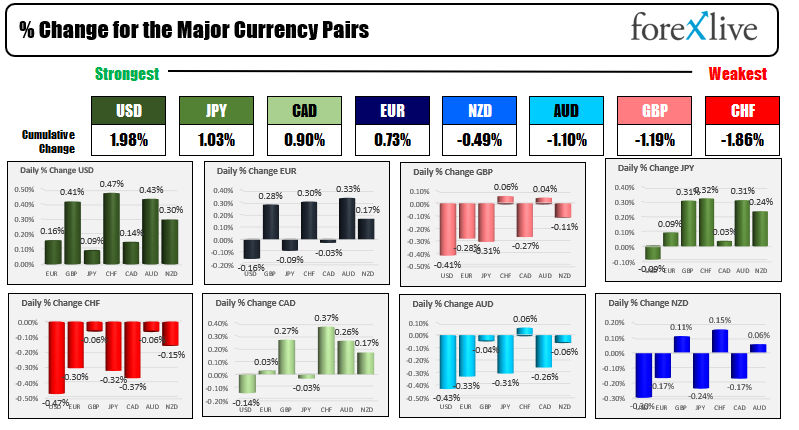

The USD is the strongest and the CHF is the weakest as NA traders enter for the day

It is non farm payroll day

In other markets ahead of the jobs reports:

- Spot gold is trading up to dollars and $0.85 or 0.16% at $1793.77. The the precious metals ups and downs continue.

- Spot silver is up three cents or 0.10% at $23.81

- WTI crude oil futures are up $0.57 or 0.72% at $79.37

- bitcoin is trading near unchanged at $61,376

In the premarket for US stocks, the major indices are modestly higher higher

- Dow industrial average is up 33 points after yesterday's -33.35 point decline.

- S&P index is up 10.2 points after yesterday's 19.49 point rise (record close)

- NASDAQ index is up 25 points after yesterday's 128.72 point rise (record close)

In the European equity markets, the major indices are trading higher. The German Dax traded to a new record (so has France and Italy).

- German DAX, +0.1%

- France's CAC, +0.75%

- UK's FTSE 100 +0.45%

- Spain's Ibex +0.7%

- Italy's FTSE MIB +0.8%

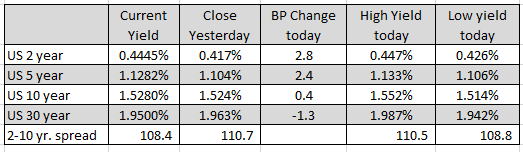

in the US, the yields on the maturity spectrum are mixed with the short rent higher and while the 30 year is lower.

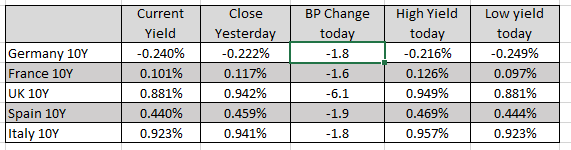

In the European debt market, the benchmark 10 year yields are lower with the UK 10 year down the most that -6.1 basis points.

November 06, 2021 at 12:15AM

Greg Michalowski

https://ift.tt/3mNndY0

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home