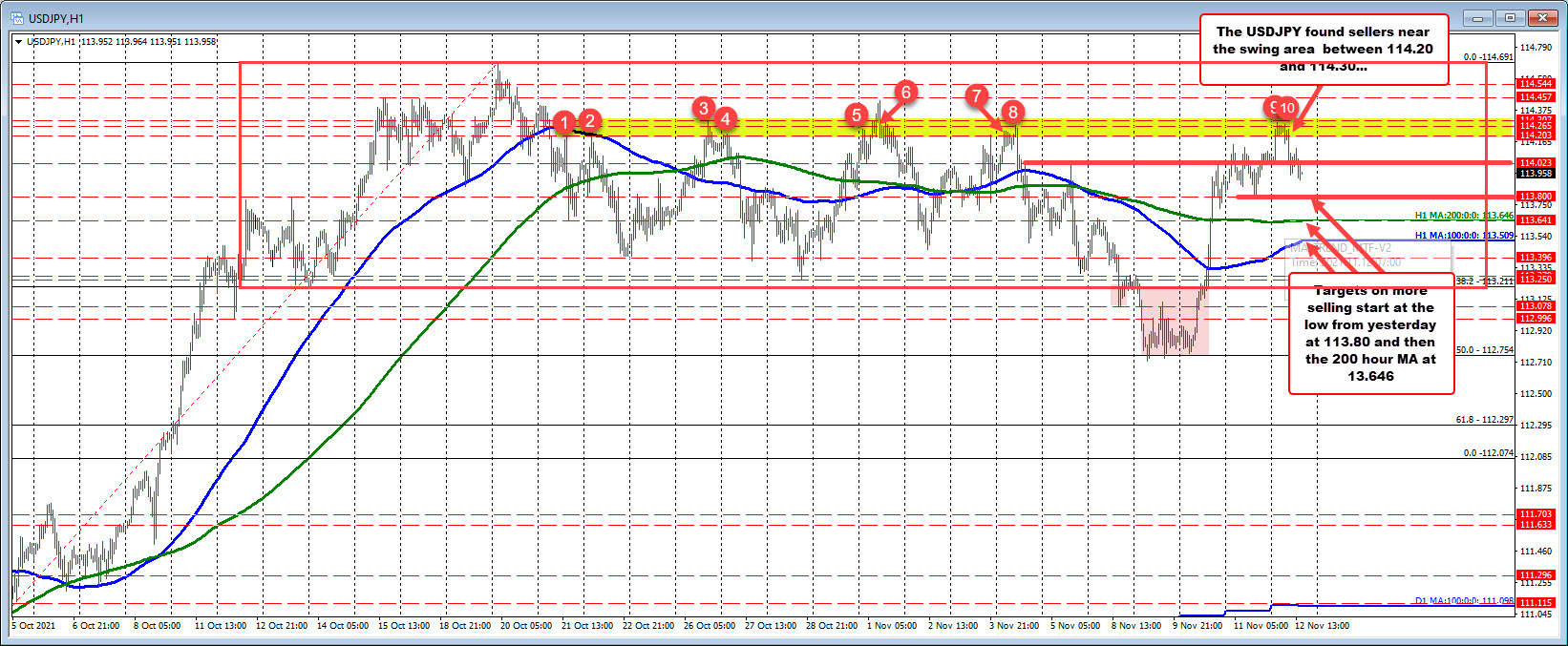

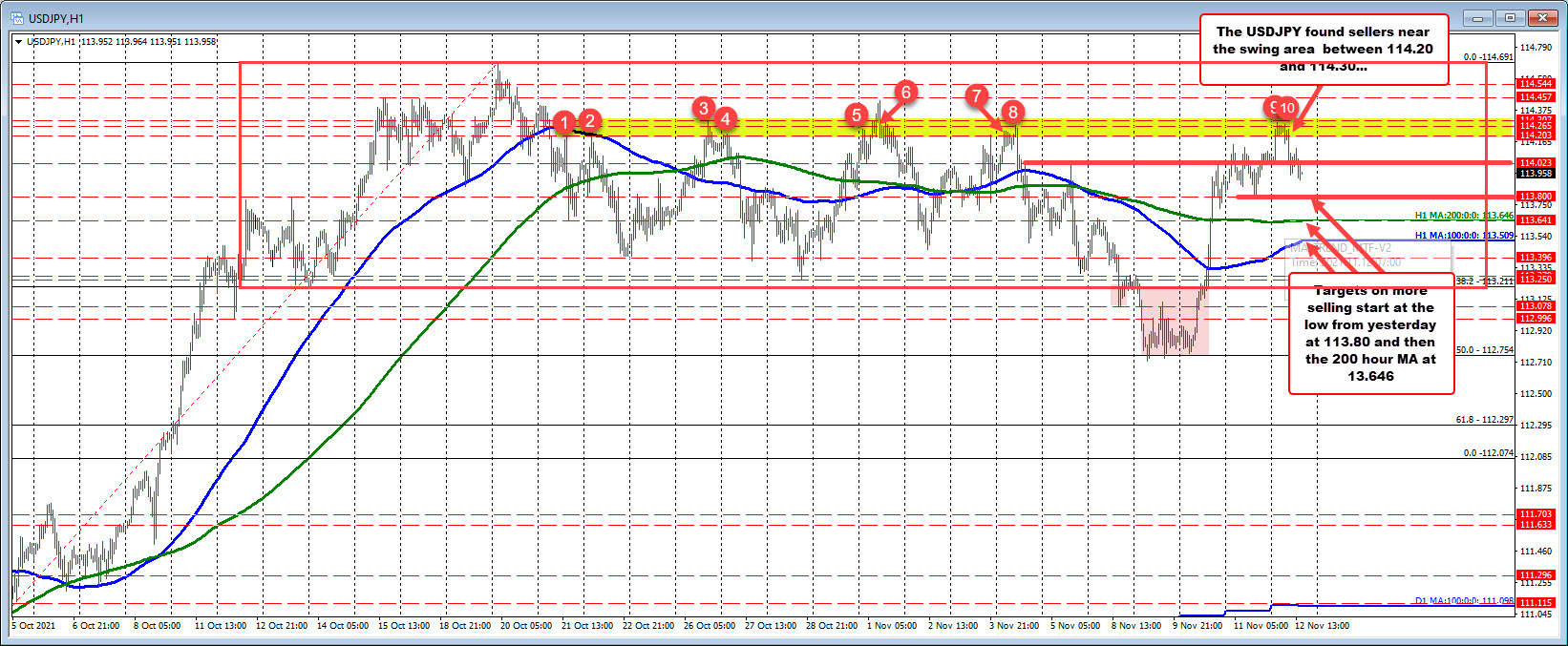

USDJPY rotated to new lows after stalling near topside resistance target area

The pair closed above the 114.00 level yesterday for the first time since October 26, but has move back below

The USDJPY has seen the price traded above the 114.00 level on a number of occasions since October 26, but that day was the last time the price closed above the level until yesterday (close yesterday was at 114.055).

Since then, the price has rotated lower, and just made a new session low at 113.916 - below the 114.00 level (and now lower on the day). On further selling, the low from yesterday 113.80 followed by the 200 hour moving average at 113.646 become the next downside targets.

On the topside get back above the 114.00 to 114.02 (high from last Friday) could lead to a run back toward the aforementioned resistance area at 113.20-113.30.

Overall sellers are more intraday, but they have more work to do to wrestle back more control.

For the week, the Monday into Tuesday bottom near the 50% midpoint of the move up from the October 4 low. That level came in at 112.754. The low for the week reach 112.719 (just below that level).

On Wednesday, the low stayed above the 50% retracement, giving the dip buyers the go ahead to push higher. The CPI data helped to extend the upside to and through the 100 hour moving average (blue line) and 200 hour MA (green line). The price remains above those moving average lines and would need to be re-broken to increase the bearish bias. Stay above and more of the control remains with the buyers in the intermediate-term..

November 13, 2021 at 02:09AM

Greg Michalowski

https://ift.tt/3Fdxt1N

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home