Locked and loaded for another edition of jobs Friday

US and Canada jobs reports to be announced at 8:30 AM ET

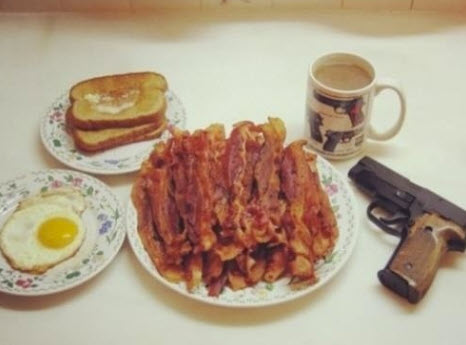

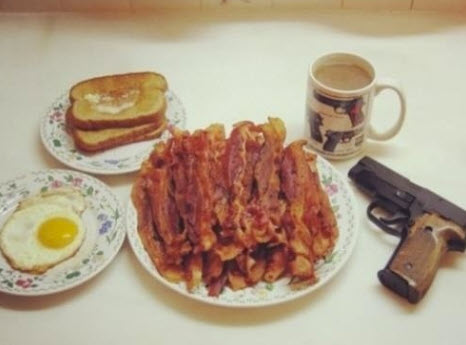

It's Unemployment (unenjoyment?) day in both the US and Canada. Traders are locked and loaded and all carbed/proteined/caffeined up for the fireworks.

The comments for Feds Powell this week may have taken some of the wind out of a weaker report. The Fed Chair (and other Fed officials) are now focused on putting the brakes on inflation via a faster taper (likely announced at the December meeting) and also tightening earlier than expectations in 2022. The caveat remains the new omicron virus but the chatter from Fed officials is more in terms of a new variant is more a risk to tighter labor (higher inflation) vs slower growth (lower inflation). The main concerns on inflation are supply chain, lower participation.

ADP released on Wednesday showed an increase of 534K. The ISM manufacturing came in near expectations at 61.1 vs 60.8 last month. The employment component index came in at 53.3 versus 52.0 in October (highest since April).

- Non Farm Payroll to add 550K jobs. That comes after a rise of 531K in October. That gain was above the 425K estimate. Job gains in September came in at 312K and August it was at 483K

- ADP nonfarm employment change came in at 534K on Wednesday. Last month ADP showed a gain of 570K which was relatively close to the 531K reported by the BLS.

- Goods producing jobs last month rose by 108,000.

- Service producing jobs increased by 496,000

- Government jobs fell by -73,000

- The unemployment rate is expected to decline to 4.5% from 4.6% last month. The unemployment rate pre-pandemic was around 3.5% and 4.4% in March 2020 before spiking higher to 14.7% in April

- Average hourly earnings are expected to come in at 0.4% versus 0.4% last month. Year on year earnings are expected to rise by 5.0% versus 4.9% last month

- Initial jobs claims during the survey week came in at 268K which was lower than the 290K last month.

- Manufacturing payrolls came in at 60K last month. The ADP report showed a gain of 50K this month

- Average workweek is expected to remain steady at 34.7

- The U6 underemployment rate is expected at 8.4% versus 8.3% last month

- Employment change 36.5K vs 31.2K last month

- Unemployment rate is expected to dip to 6.6% from 6.7% last month

- Labor productivity QoQ is expected to come in at -0.7% versus +0.6%

December 04, 2021 at 01:08AM

Greg Michalowski

https://ift.tt/3xRTqBp

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home