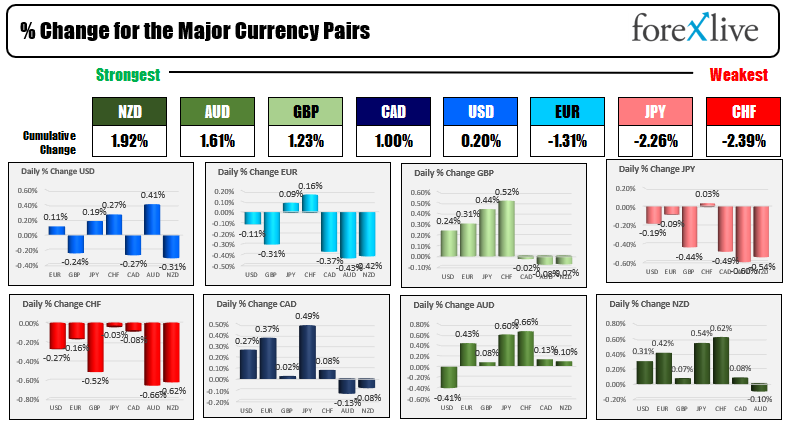

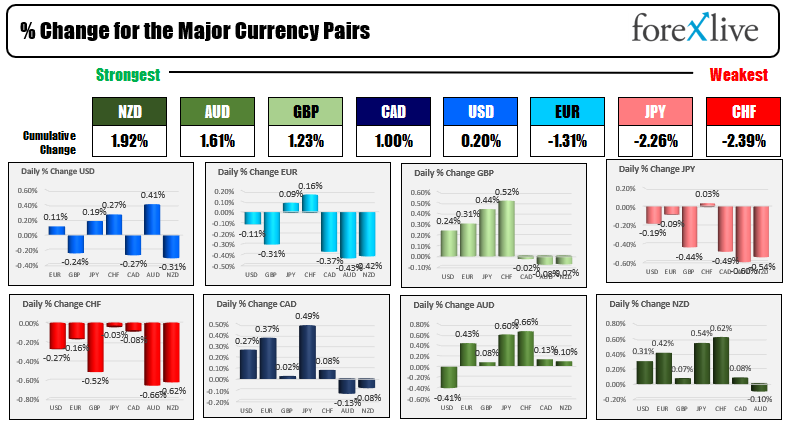

The NZD is the strongest and the CHF is the weakest as NA session begins

The USD is mixed ahead of Powell II testimony

The NZD is the strongest and the CHF is the weakest as North American traders enter for the day. The USD is mixed as Fed Chair Powell switches to the House of Representatives.

Yesterday in front of the Senate Banking Committee, Powell shifted away from "inflation is transitory" to admitting it is likely to stay around for a period longer than "transitory". As such, he also tilted his bias toward tapering faster (Fed will discuss at the December meeting).

Oil tumbled, stocks tumbled, the yield curve flattened (longer end yields moved lower), the USD initially moved higher, but did correct off the highs by the close. The omicron virus was also a contributor to the trends.

Today, the story is NOT the same. Oil is higher. Stocks are higher. The yield curve is continuing to flatten with yields higher across the board. The dollar is mixed. The omicron virus fear has subsided.

In addition to Powell II on Capitol Hill, AP nonfarm will be released at 8:15 AM ET. Canada building permits (8:30 AM ET), Canada manufacturing PMI (9:30 AM ET), US Markit final manufacturing PMI (9:45 AM ET), the ISM manufacturing PMI, and construction spending (both at 10 AM ET) will highlight the economic releases. The weekly EIA crude oil inventories will also be released at 10:30 AM ET (private data showed crude oil inventories fell -0.747M vs estimate of -1.66M exp), and the Federal Reserve beige book (at 2 PM) complete a full day of releases and events.

In other markets:

- Spot gold is up $12.40 or 0.70% at $1786.32

- Spot silver is up $0.11 or 0.48% at $22.91

- Crude oil is up $2.24 at $69.18

- Bitcoin is trading near unchanged $57,134

In the premarket for US stocks, the futures are implying higher openings after yesterday's sharp declines:

- Dow industrial average, +354 points after falling -652.22 points yesterday

- S&P index +61.5 points after yesterday's -88.25 point decline

- NASDAQ index +250 points after yesterday's -245 point decline.14

In the European equity markets, the major indices have also rebounded

- German Dax, +1.9%

- France's CAC, +1.7%

- UK's FTSE 100 +1.5%

- Spain's Ibex, +1.7%

- Italy's FTSE MIB +1.8%

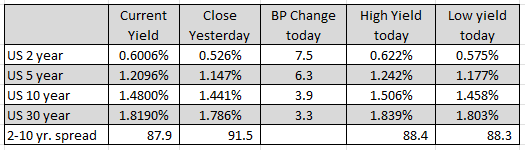

In the US debt market, yields in the shorter end continue to extend to the upside with the two year yield up 7.5 basis points:

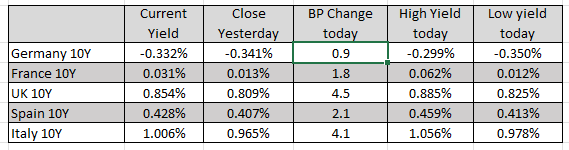

In the European debt market, the benchmark 10 year yields yields are higher as well.

December 02, 2021 at 01:02AM

Greg Michalowski

https://ift.tt/32PzF1P

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home