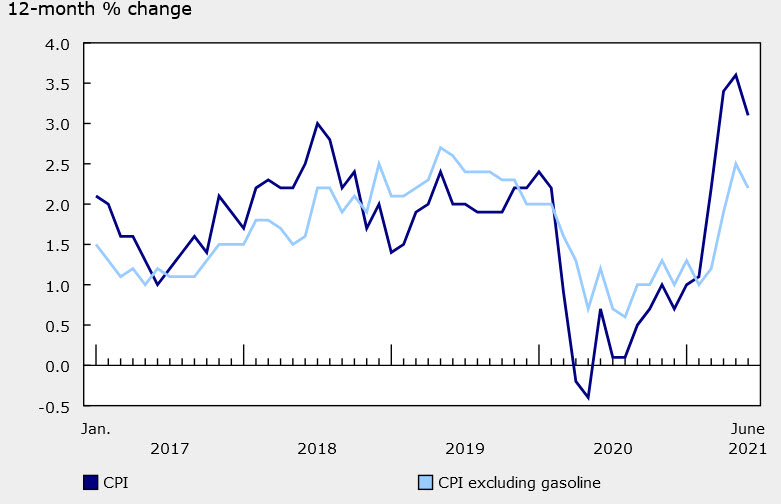

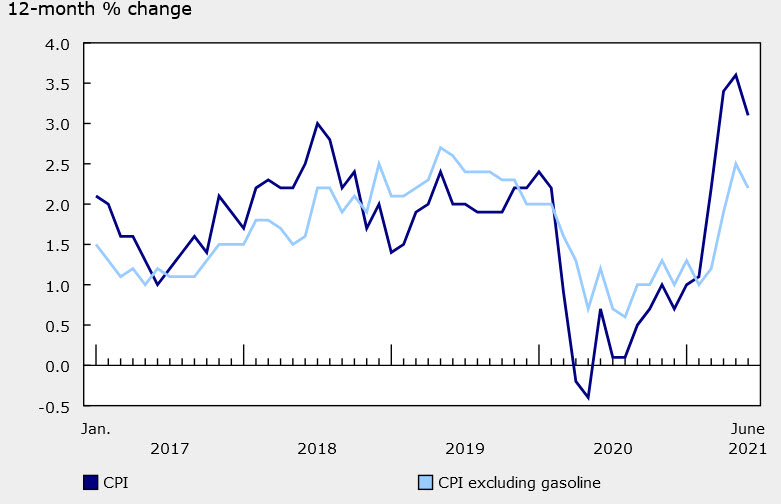

Canada June CPI +3.1% vs +3.2% y/y expected

Canadian June consumer price index data

- Prior was +3.6% y/y

- CPI +0.3% m/m % vs +0.4% expected

- Prior m/m reading was 0.5%

- Full report

- Median 2.4% vs 2.3% exp (prior 2.4%)

- Common 1.7% vs 1.9% exp (prior 1.8%)

- Trim 2.6% vs 2.6% exp (prior 2.7%)

USD/CAD was trading at 1.2568 ahead of the release and climbed to 1.2580 afterwards. If we've seen the peak in this data then it will significantly diminish the pressure on central banks to raise rates and taper.

In terms of details, shelter rose 4.4% and transportation 5.6% while gasoline slowed to 32.0% from 43.4%.

Shelter prices are going to be a big problem in Canada and elsewhere, driving persistently high inflation numbers. A dig into the data shows why. Rental and buying costs are going up but that's been offset by a 8.6% y/y decline in the mortgage cost index due to lower interest rates. However rates have only one way to go now so that will soon be a tailwind to prices while higher rents slowly work their way through.

July 29, 2021 at 12:30AM

Adam Button

https://ift.tt/3iZAfhI

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home