EURUSD continues to move higher after weaker GDP/jobless claims

EURUSD steps through technical levels today

The move off the bottom, then pushed higher with the pair moving up to test the 1.18507 before the close (swing area between 1.18467 to 1.18507). The price moved sideways in the early Asian session, but based against the 38.2% retracement at 1.18366 before breaking above the aforementioned a swing area (above 1.18507). After breaking, there was a retest of the broken area, where buyers entered. That was the clue the buyers needed, and they have race the price higher since then.

The pair has moved above the 50% midpoint at 1.18629 and tested a swing area between 1.1877 and 1.18815. The pair has broken the high of that swing area, but his back within the swing area currently.

What next?

Buyers are trending the pair. Off the hourly chart, the longs won't get too concerned until the 50% midpoint is rebroken (of the July trading range) Closer risk is the 1.1877 low swing area for new buyers mainly.

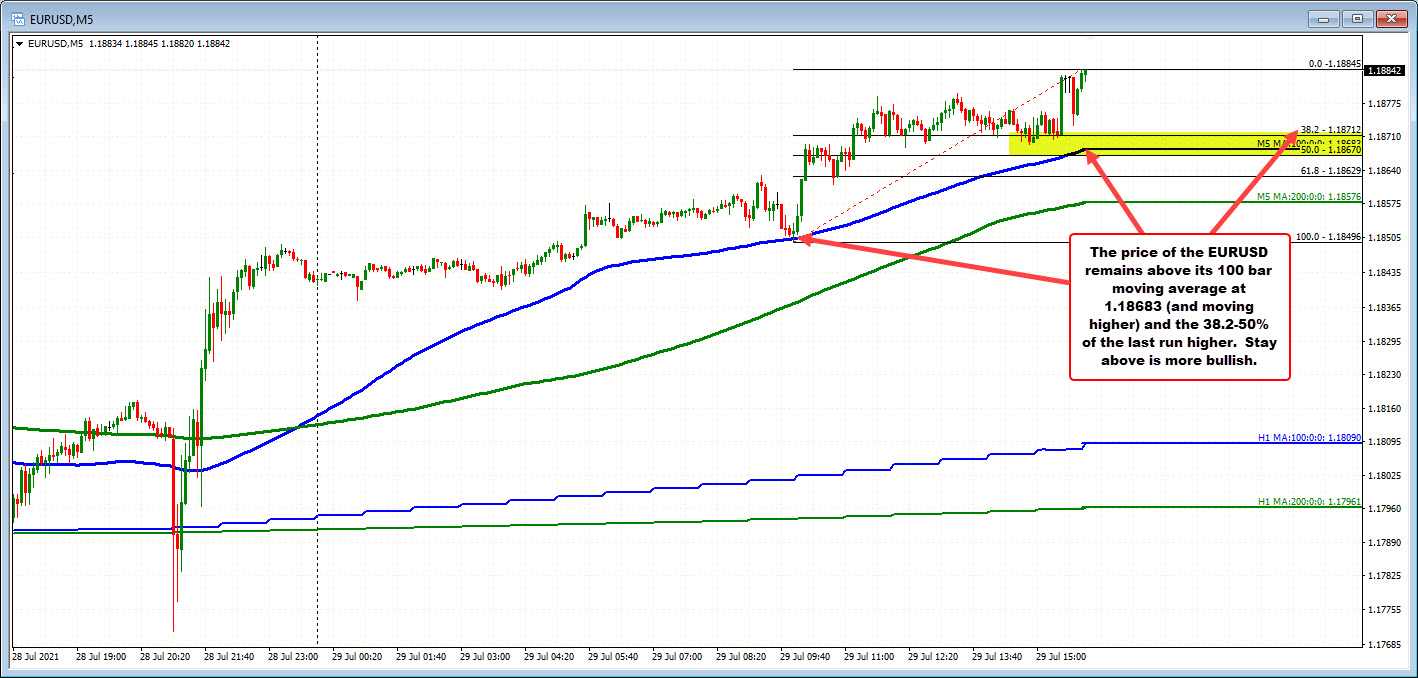

Other clues could comes from the 5 minute chart below. The price has been able to stay above its 100 bar moving average on the largest correction today. The most recent sideways move has seen the moving average gets closer to the price, but the pair still remains above that level. The 100 bar moving average comes in at 1.18683 (and moving higher). The current price is at 1.1883. The 38.2% -50% retracement comes in at 1.1867 to 1.18712. Stay above that retracement area and the 100 bar MA, keeps the buyers in control.

The next upside target comes against the 61.8% retracement of the range since the June 25 high. That comes in at 1.18893. Above that the July 6 high price at 1.18947 would also be targeted.

July 30, 2021 at 01:06AM

https://ift.tt/3l9VkJk

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home