Markit July US services flash PMI 59.8 vs 64.8 expected

Markit July US services flash PMI 59.8 vs 64.8 expected

Highlights of the Markit US PMIs

- Prior was 64.6

- In services "some firms noted customer hesitancy amid significant hikes in selling prices"

- Firms noted the lowest degree of optimism since February

- New export orders eased

- Manufacturing 63.1 vs 62.1 expected

- Composite PMI 59.7 vs 63.7 prior

- Full report

This is a five-month low for the services index and given that we're at prime time in the reopening, that's not a great sign. That said, the survey downplays it noting that growth is continuing at a slower pace.

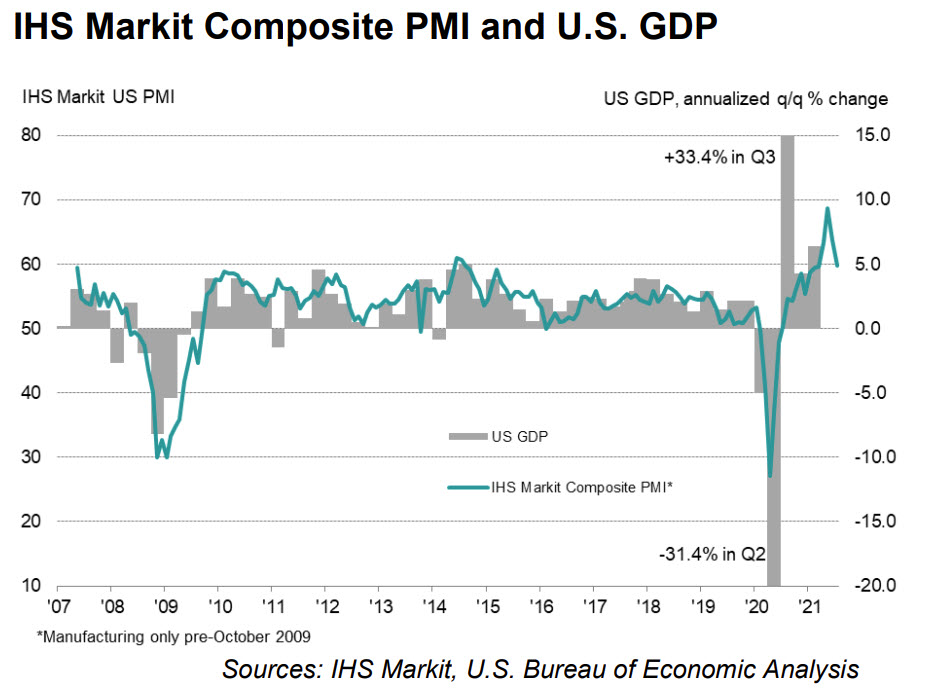

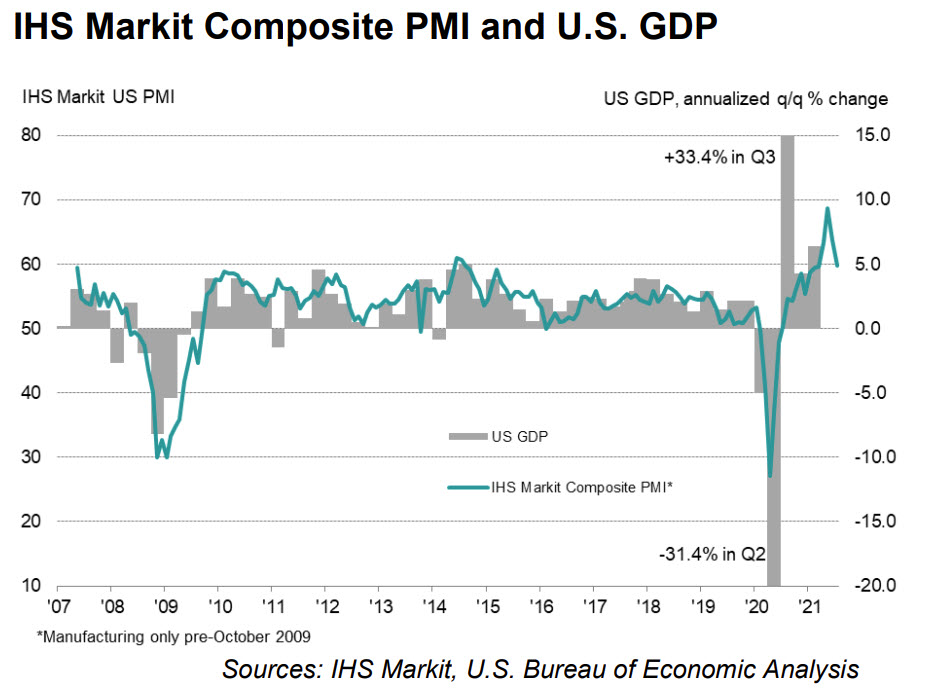

"The provisional PMI data for July point to the pace of economic growth slowing for a second successive month, though importantly this cooling has followed an unprecedented growth spurt in May," said IHS Markit chief economists Chris Williamson. "Some moderation of service sector growth in particular was always on the cards after the initial reopening of the economy, and importantly we're now seeing nicely-balanced strong growth across both manufacturing and services."

The ISM manufacturing report is due out Aug 2 and the services report Aug 4.

More from Williamson:

"While the second quarter may therefore represent a peaking in the pace of economic growth according to the PMI, the third quarter is still looking encouragingly strong."Short-term capacity issues remain a concern, constraining output in many manufacturing and service sector companies while simultaneously pushing prices higher as demand exceeds supply. However, we're already seeing signs of inflationary pressures peaking, with both input cost and selling price gauges falling for a second month in July, albeit remaining elevated."Inflationary pressures and supply constraints - both in terms of labour and materials shortages - nevertheless remain major sources of uncertainty among businesses, as does the delta variant, all of which has pushed business optimism about the year ahead to the lowest seen so far this year. The concern is this drop in confidence could feed through to reduced spending, investment and hiring, adding to the possibility that growth could slow further in coming months."

Overall, this is a disappointing report and some of the air is coming out of commodity currencies.

Invest in yourself. See our forex education hub.

July 24, 2021 at 01:45AM

https://ift.tt/3y1X4I6

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home