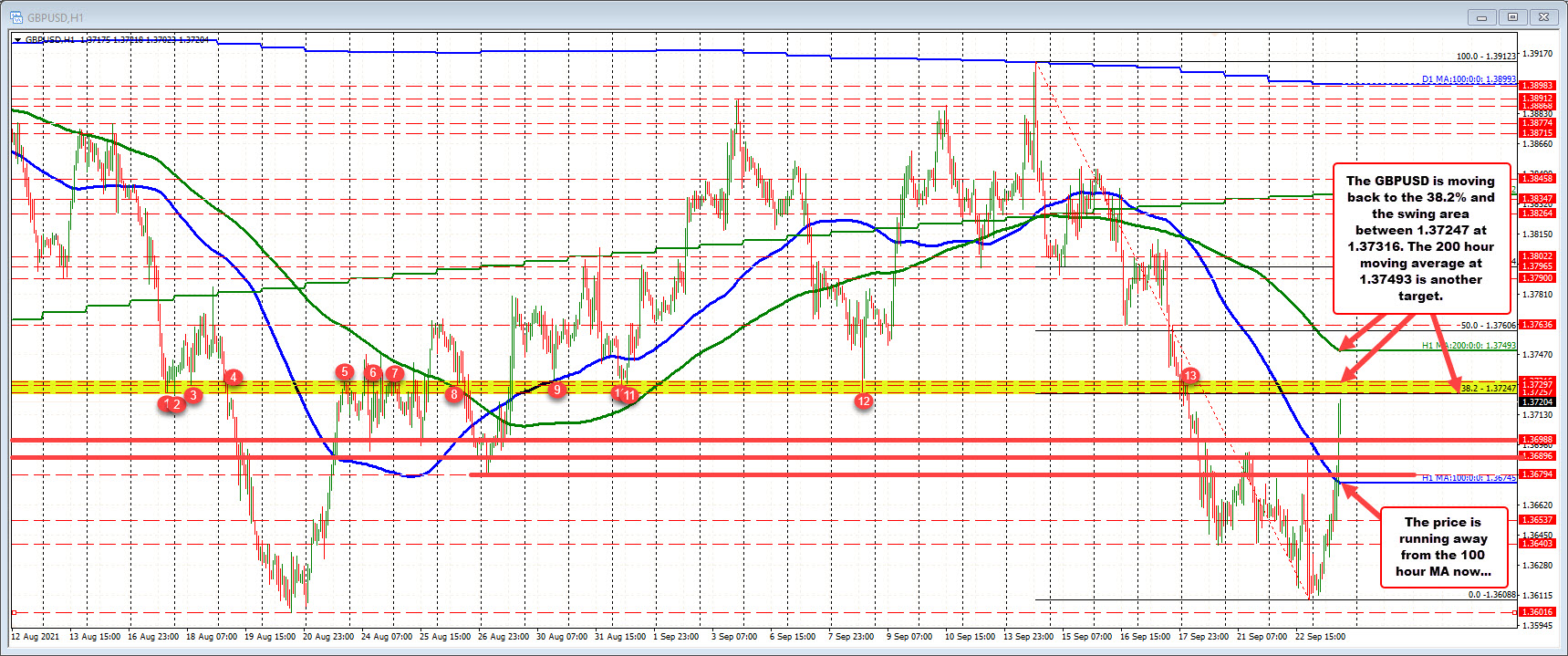

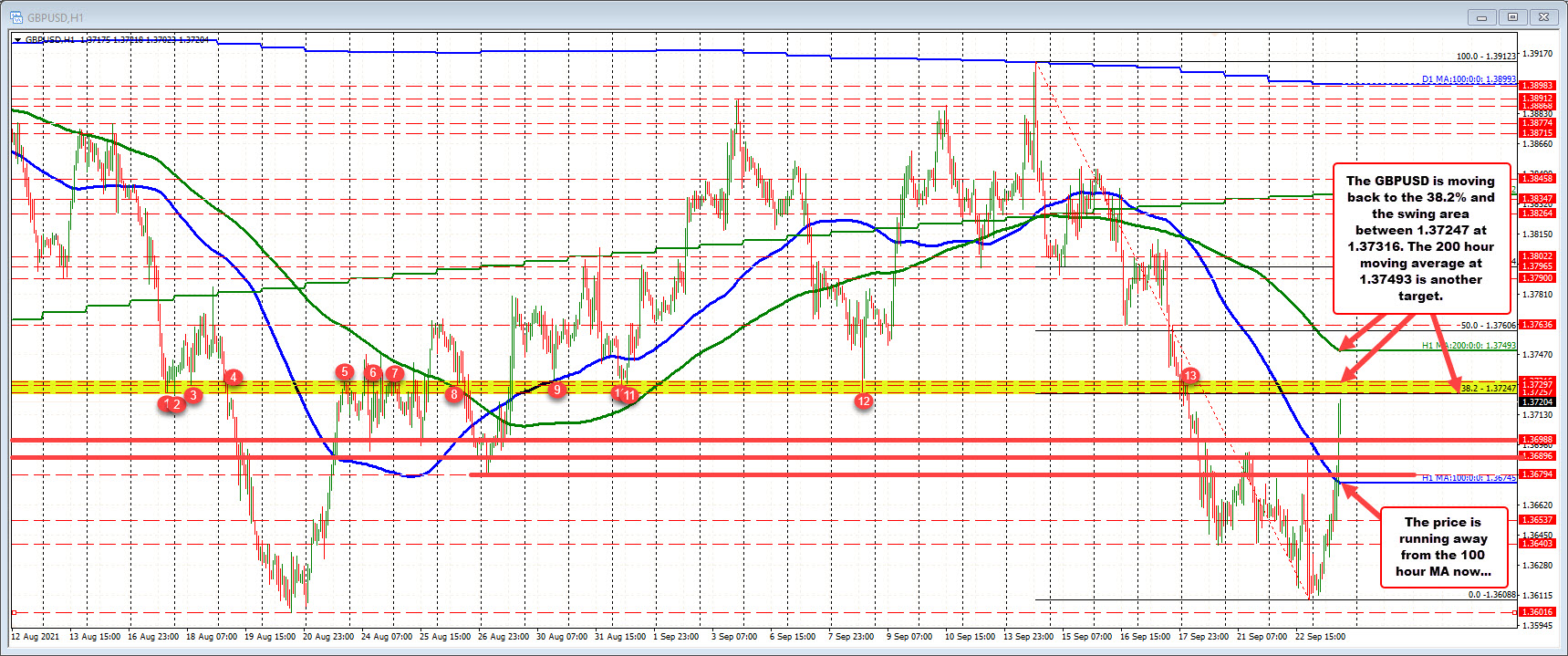

The GBPUSD trades to a new high. Approaches key swing area

38.2% retracement and swing area between 1.37257 and 1.37316

The GBPUSD is traded to a new high for the day and in the process is looking to test the 38.2% retracement of the move down from the September 13 high at 1.37247 and a swing area (see red numbered circles) at 1.37247 to 1.37316. The price just reached a high of 1.37249.

Technically a move above the aforementioned swing area would have traders looking toward the 200 hour moving average 1.37488.

Conversely should sellers leaned against the swing area (risk is defined and limited with stops on a break above), on the downside, a move back below the 1.3700 level would be close risk. Other risk for GBPUSD buyers would be if the price moved back below the 100 hour moving average 1.36739.

September 24, 2021 at 01:05AM

https://ift.tt/3kxR8SI

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home