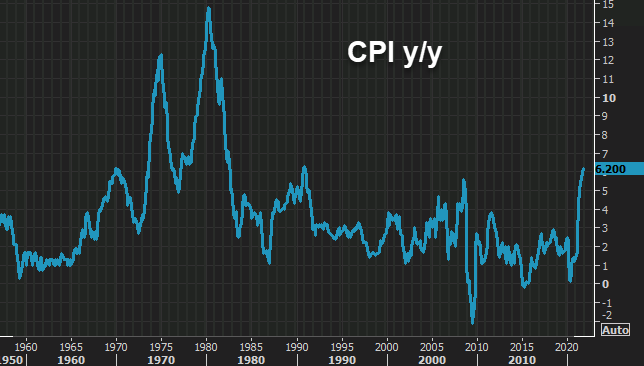

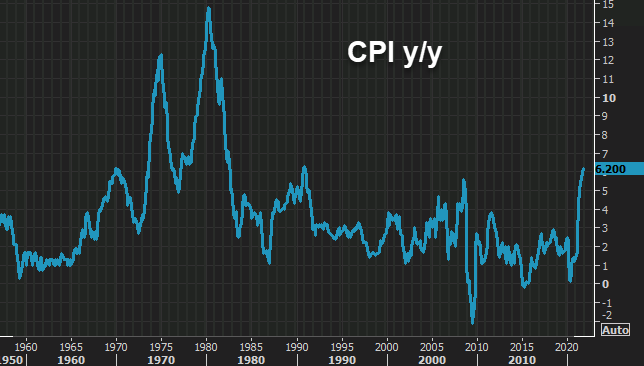

US October CPI +6.2% y/y vs +5.8% expected

US October 2021 consumer price index data

- Highest since 1990

- Prior was 5.4%

- m/m CPI +0.9% vs +0.6% expected

- Prior m/m reading was +0.2%

- Real weekly earnings -0.9% vs +0.8% prior

Core inflation:

- Ex food and energy +4.6% vs +4.3% y/y expected

- Prior ex food and energy +4.0%

- Core m/m +0.6% vs +0.4% exp

- Prior core m/m +0.2%

- Full report

The US dollar has jumped on the headlines around 20 pips across the board.

More details:

- CPI food +0.9% m/m

- Housing +0.7% m/m

- Owners' equivalent rent +0.4%

- CPI energy +4.8%

- Gasoline +6.1%

- New vehicles +1.4%

- Used cars +2.5%

Credit Suisse said a rise in housing of more than 0.5% would be a potential signal of more persistent inflation.

November 11, 2021 at 01:30AM

Adam Button

https://ift.tt/3bWzP8P

Labels: Forexlive RSS Breaking News Feed

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home